DTH Update

Operators Rush to OTT Life Raft as DTH Mother Ship Begins to Sink

Terminal DTH decline has its roots in US cable churn starting around 2010, spreading to North-American satellite operators a few years later. The exodus is still gathering speed and spreading to Europe, leaving operators scrambling to mop up their departing customers via the life rafts of OTT. The problem is they can never charge the high subscriptions they used to so that it will be difficult or impossible to maintain ARPUs at historical levels, even if they succeed in catching all those churning subscribers.

While Sky in Europe has been quite successful holding up overall subscriber numbers with its Now TV skinny bundle in Europe, the wheels have come off for AT&T in the US as even DirecTV Now, its stand-alone OTT alternative to the main DTH service, has been losing subs after initial gains.

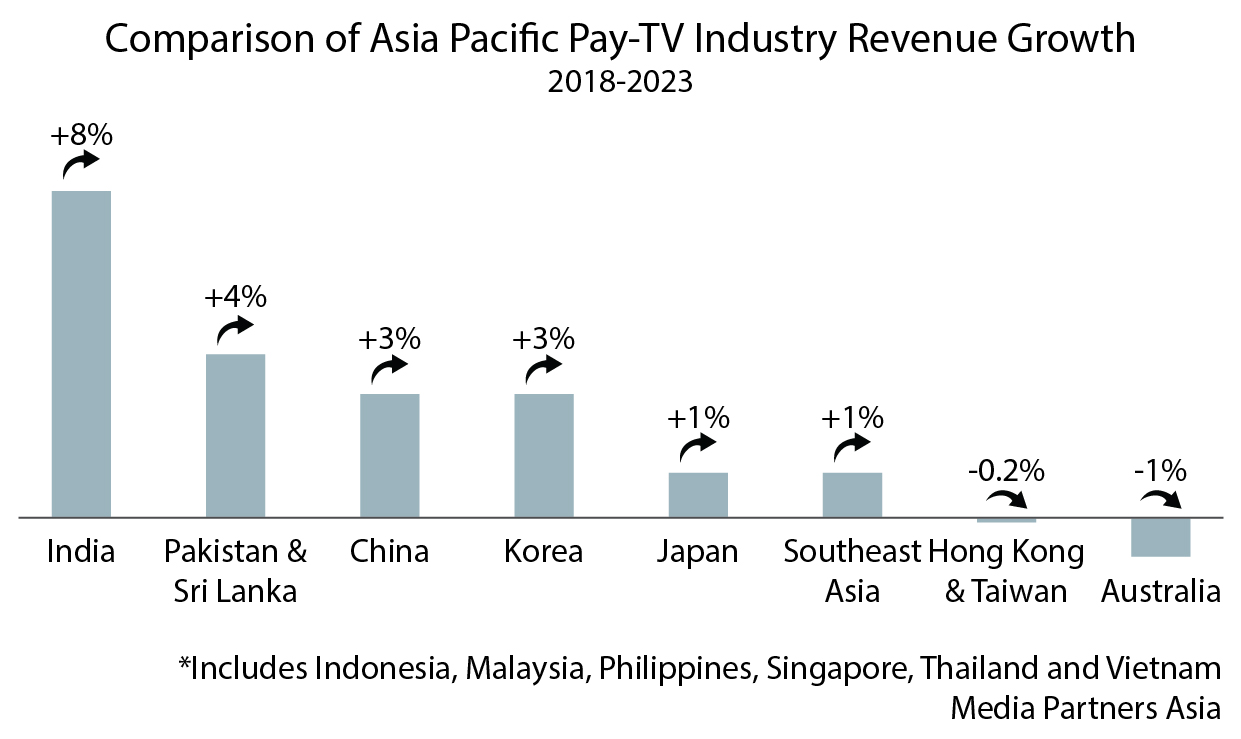

DTH thrives where there is no competitive alternative for receiving premium content, or where one operator succeeds in hogging the most sought-after rights. The latter is how DTH acquired its dominant position in so many markets, such as Sky in its European markets, especially the UK, while becoming at least a substantial force in many others, such as the US, France, and Germany. Meanwhile DTH has provided the engine of growth for pay-TV in a number of developing markets, notably India, but in these cases it has been hamstrung by low ARPU rather than churn.

Many Indian satellite operators have faced the challenge of becoming profitable even though they are sustaining rapid growth, and that will remain the case during the forecast period. Some Indian operators will be more successful than others in raising ARPU to boost the bottom line.

Latin America has rather more in common with the U.S. than Asia, with DTH having led a rapid growth in pay-TV over the period 2008 to 2014 on the back of an expanding middle class in key markets, including the big two of Brazil and Mexico. The charge was led by DirecTV Latin America and Sky Brasil, now both folded into Vrio under AT&T’s ownership, along with America Movil’s Claro TV and Dish Mexico, all of which now face a swing toward broadband delivery as infrastructures expand.

China, as in other departments of pay-TV, is a unique case, even more so for DTH, where there are large numbers of FTA viewers of regional channels, but few opportunities for global providers to move in, given regulatory constraints and government paranoia. China then is a black hole when it comes to pay-DTH and does not feature in these forecasts, although the data includes the total FTA subscriber population for those commercial FTA services funded by advertising.

China apart, three DTH categories by geography may be considered: the Americas, Europe, and then developing countries, largely in Asia-Pacific and Africa along with Oceania.

The Americas are leading the decline such that DTH will be well on the way toward extinction by the end of the forecast period, at least in the US In Europe, the picture is more mixed, with the decline well advanced for some operators, such as France’s Canal+, whose base will be halved by 2024 compared with 2018. But some Eastern European markets have profiles more like developing countries, most notably Cyfrowy Polsat in Poland, set to continue gaining subs for the next few years. However, even these operators will run out of rope very soon and join the rest of the field in DTH decline.

In Asia-Pacific, DTH subscriber growth will be sustained throughout the period, but with signs of flattening off later in preparation for decline setting in there too around 2024, as at Tata Sky and Dish TV India. We anticipate some Asia-Pacific operators that are still growing subs now reaching a turning point with decline setting in before 2024, examples being Cignal in the Philippines and Tata Sky in India. Yet others are in decline already, usually where other factors come into play, such as a loss of key rights especially sports.

Squaring all regions together, the recent global rise in DTH will come to an end in 2020 with an accelerating decline by the close of 2024 as more and more DTH operators in Asia-Pacific pass their summit. Rapid TV News

You must be logged in to post a comment Login