Headlines Of The Day

Tata Sky to go public, Disney to exit

Tata Sky, the satellite television business of the Tata group, will soon file draft share sale documents with the markets regulator for an initial public offering (IPO) by end-March, two people aware of the development said.

“Work on the draft IPO prospectus is in advanced stages and could be filed with Sebi (Securities and Exchange Board of India) by next month; so, the deal could possibly be launched before the end of this fiscal,” one of the two people said. Kotak Mahindra Capital is advising Tata group on the IPO, the person said, adding a couple of foreign investment banks are also involved.

The proposed IPO’s size may be ₹2,000-3,000 crore, with a mix of primary capital raising for use in the business and secondary share sales by existing investors, the second person said.

Due diligence

The IPO will present an exit to buyers, particularly Disney, which has been trying to promote its stake, the folks cited above stated, requesting anonymity

“Disney doesn’t have investments in some other distribution platform other than Tata Sky. That is non-core for them, and so they wish to concentrate on their principal consumer-focused enterprise of Disney+, given the fierce competitors within the OTT market. Different choices have been explored previously to both usher in a strategic investor or Tatas shopping for Disney’s stake; however proper now, it seems just like the IPO is the best way ahead for the corporate,” stated the second particular person.

“There are different buyers, too, comparable to Temasek and Tata Capital, who’ve been invested within the firm for a very long time. They, too, want to dilute a few of their stake. Disney, too, will promote a part of its stake within the IPO,” he added.

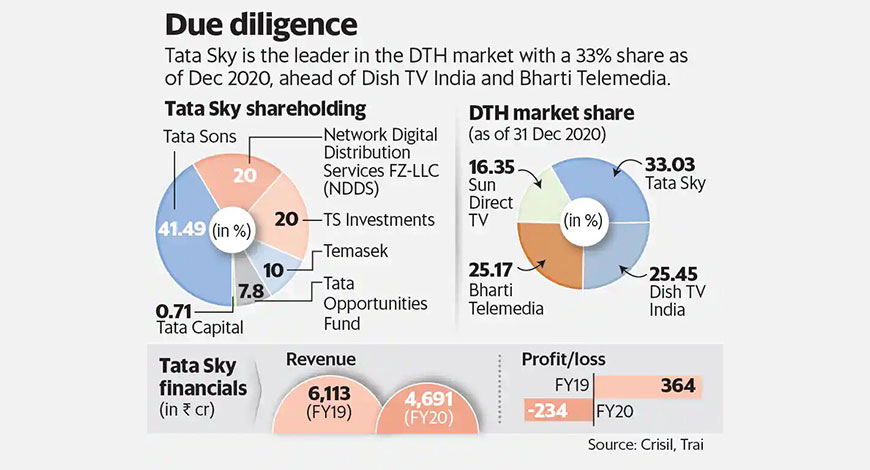

Tata Sky began operations in 2004 as an 80:20 three way partnership between Tata Sons and Community Digital Distribution Providers FZ-LLC, an entity owned by Rupert Murdoch’s twenty first Century Fox. Disney acquired Fox in 2019. Disney owns an extra 9.8% stake in Tata Sky by TS Investments Ltd, the place Fox owned a 49% stake, with Tata proudly owning the remaining. In FY08, Baytree Investments (Mauritius) Pte Ltd (Bay Tree), an affiliate of Temasek, acquired a ten% stake in Tata Sky, whereas in FY13, Tata Alternatives Fund and Tata Capital Ltd acquired an fairness stake within the agency. Tata Sons has a 41.49% stake within the firm.

Temasek and Tata Capital declined to remark. Emails despatched to Tata Sons and Disney remained unanswered until press time.

Tata Sky is the chief within the DTH market with a 33% share as of December 2020, forward of Dish TV India, Bharti Telemedia and Solar Direct TV, whose market share stood at 25.45%, 25.17% and 16.35%, respectively, based on a report by the Telecom Regulatory Authority of India (Trai). Tata Sky’s market share went up from 32.3% as of 31 March 2020, information exhibits.

Regardless of covid, the full energetic subscriber base for the DTH business has grown from 70 million on the finish of 2019 to 71 million as of 31 December 2020, Trai information exhibits.

“(Tata Sky’s) market place has strengthened with the implementation of NTO 1.0 (new tariff order), leading to a pointy addition of customers, and is supported by the most important high-definition subscriber base within the business,” score company Crisil stated in a word in October 2020.

For FY20, Tata Sky reported a drop in income to ₹4,691 crore from ₹6,113 crore within the earlier 12 months. The corporate reported a lack of ₹234 crore in FY20 from a revenue of ₹364 crore within the earlier 12 months.

“The business includes giant capex as operators must undertake important institution value (comparable to set up companies) and working bills (comparable to promoting ) to make sure sustained ramp-up in scale. Tata Sky faces intense competitors. Furthermore, DTH operators face the danger of technological obsolescence,” Crisil stated.

You must be logged in to post a comment Login