Headlines Of The Day

Weak Q4 FY23 expected from broadcasters

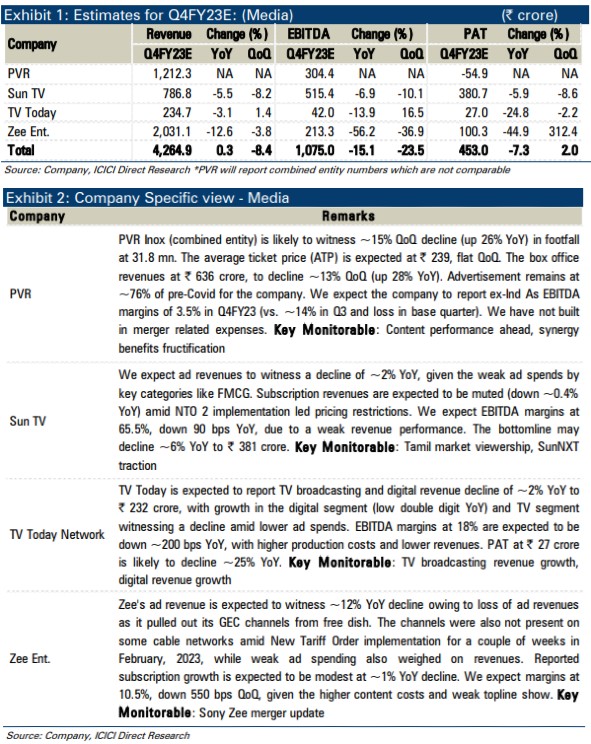

For broadcasters, Q4 is expected to be a weak quarter on the ad front given the muted ad spending by FMCG and impact of free to air channel exit. For multiplexes, Pathaan headlined the box office amid a muted quarter.

Multiplex: PVR Inox merged entity to report first quarter

Q4 was a relatively weak quarter for the box office barring Pathaan, which emerged a blockbuster with ~| 500+ crore, net box office collection. Thus, PVR Inox (combined entity) is likely to witness ~15% QoQ decline (up 26% YoY) in footfall at 31.8 mn. The average ticket price (ATP) is expected at | 239, flat QoQ. Consequently, box office revenues at | 636 crore are likely to decline ~13% QoQ (up 28% YoY). Advertisement remains at ~76% of pre-Covid for the company. We expect the company to report ex-Ind As EBITDA margins of 3.5% in Q4FY23 (vs. ~14% in Q3 and loss in base quarter). With a decent content line-up ahead, box office collection momentum is a key monitorable ahead. Another key monitorable is fructification of synergy benefits for PVR Inox (targeting EBITDA levels benefit of | 225 crore over 12-18 months).

Broadcasters: Weak performance likely on ad front!

During Q4FY23, GEC broadcasters are expected to witness a weak quarter with YoY ad decline owing to a) exit of free to air channel by Zee; b) weak ad spending by key categories including FMCG and c) Zee channels not being present on some cable networks amid New Tariff Orderimplementation for a couple of weeks in February, 2023 (now resolved).

Sun TV’s ad revenues are likely to see a decline of ~2% YoY, given weak ad spends. Subscription revenues are expected to be muted (down 0.4% YoY). We expect EBITDA margins at 65.5%, down 90 bps YoY, due to a weak revenue performance. Bottomline may decline ~6% YoY to | 381 crore. Zee’s ad revenue is expected to witness ~12% YoY decline owing to loss of ad revenues as it pulled out its GEC channels from free dish. The channels were not present on some cable networks amid New Tariff Order implementation for a couple of weeks in February, 2023, while weak ad spending also weighed on revenues. Reported subscription growth is expected to be modest at ~1% YoY decline. We expect margins at 10.5%, down 550 bps QoQ, given the higher content costs and weak topline show.

For TV Today, we expect ~2% YoY decline in TV and digital revenues, with growth in the digital segment (low double-digit YoY) and TV segment witnessing a decline amid lower ad spends. EBITDA margins at 18% are expected to be down ~200 bps YoY, with higher production costs and lower revenues.

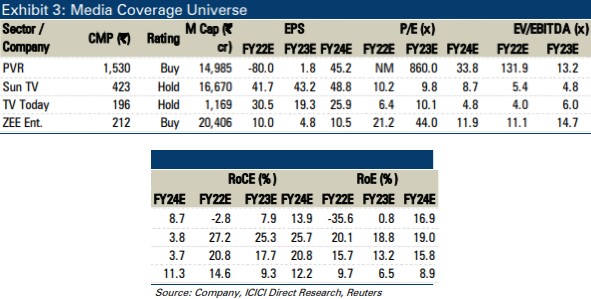

Going ahead, TV ad recovery would hinge on resumption of ad spends by FMCG players. An ad recovery would also be key in margin improvement for broadcasters, going ahead. Zee Sony merger completion would be another key development to watch.

ICICI Direct