Headlines Of The Day

Indian M&E sector grew 20% in 2022, touching the highest ever mark of INR2 trillion says Ficci-EY report

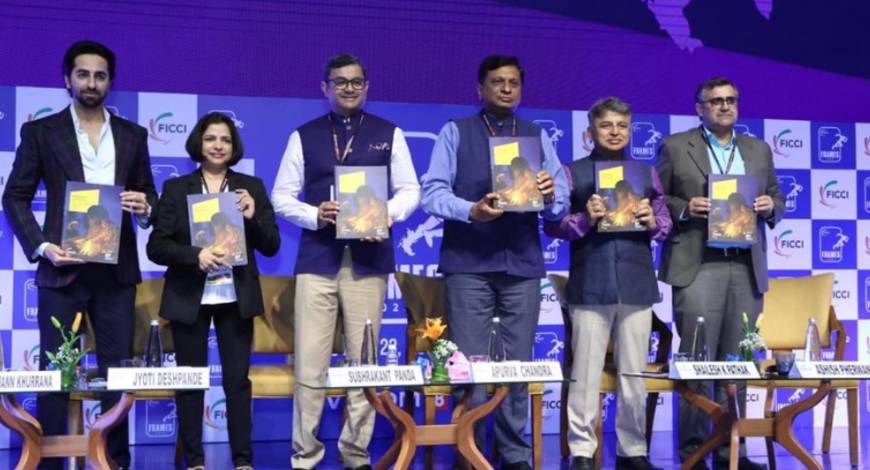

According to the FICCI-EY report ‘Windows of opportunity – India’s media & entertainment sector maximizing across segments’ launched today at the FICCI FRAMES 2023 in Powai, the Indian Media and Entertainment (M&E) sector grew 20% in 2022 to reach INR2.1 trillion (US$26.2 billion), 10% above its pre-pandemic levels in 2019.

Digital media has grown significantly, reaching INR571 billion and increasing its contribution to the M&E sector from 16% in 2019 to an astonishing 27% in 2022. It is important to note that the digital segment’s share of the entire M&E sector would rise to 50% if data costs were also to be factored in.

Ashish Pherwani, EY India Media & Entertainment Leader, stated, “The Indian M&E consumer base is large but heterogenous, hungry for content but willing to pay only for value, and more than ready to experiment with technology, be it streaming, digital payments, online education, virtual experiences, e-commerce, social media, or gaming. The diverse consumer base, coupled with favourable macroeconomic and demographic factors, have translated into a very exciting time for the sector.”

Jyoti Deshpande, Co-Chairman, FICCI Media and Entertainment Committee, said “It’s an exciting time to be in the M&E business, as we leverage the three pillars of the industry – content, commerce, and community, fuelled by technological innovation. The sector is expected to grow 11.5% in 2023 to reach INR 2.34 trillion and further grow at a CAGR of 10.5% to reach INR 2.83 trillion by 2025. Through democratisation of the creator economy and disruption in digital distribution, I dream of an India with infinite storytellers finding infinite platforms to share their stories, engaging with audiences in every language, with India leading the charge across the global entertainment landscape.”

Experiential (outside the home) segments recovered in 2022

Filmed entertainment, live events and Out-of-home media segments together contributed 40% of the M&E sector’s total growth in 2022.

Advertising continued to outperform Indian GDP growth

At INR1,049 billion, advertising exceeded the INR1 trillion benchmark for the first time. In 2022, when India’s nominal GDP grew 15%, advertising recovered 19%. It is now 0.4% of India’s GDP, much lower than developed large markets like the US, Japan, and China, which are all between 0.6% and 1%.

M&A activity continued strong in 2022

There were over 125 deals in 2022 compared to 118 in 2021, of which 65% were in digital, gaming, and new media segments.

The M&E sector will grow at a CAGR of 10.5% to reach INR2.8 trillion in 2025

The key contributors to this growth will be digital, online gaming and television (together contributing to 65% of the growth), followed by animation and VFX (11%), live events (8%) and films (8%)

Segmental performance in 2022

- Television – Television advertising grew 2% to end 2022 just behind its 2019 levels, on the back of volume growth. Subscription revenue continued to fall for the third year in a row, experiencing a 4% de-growth due to a reduction of five million pay TV homes and stagnant consumer-end ARPUs. While linear viewership declined 7% over 2021, 8 to 10 million smart TVs connected to the internet each day, up from around 5 million in 2021.

- Digital advertising – Digital advertising grew 30% to reach INR499 billion, or 48% of total advertising revenues. Included in this is advertising by SME and long-tail advertisers of INR180 billion and advertising earned by e-commerce platforms of INR70 billion.

- Digital subscription – Digital subscription grew 27% to reach INR72 billion. 99 million paid video subscriptions across almost 45 million Indian households generated INR68 billion. Due to a plethora of free audio options, just 4 to 5 million consumers bought music subscriptions, generating INR2.2 billion while online news subscriptions generated INR1.2 billion.

- Print – Advertising revenues grew 13% in 2022 as print remained a “go-to” medium for more affluent and non-metro audiences. Subscription revenues grew 5% on the back of rising cover prices and has stabilized at 15% to 20% below the pre-COVID-19 levels. Digital revenues remain elusive for most newspaper companies.

- Film – The segment grew 85% to reach 90% of its 2019 levels as theatres re-opened. Over 1,600 films were released in 2022, theatrical revenues crossed INR100 billion, and fewer films released directly on digital platforms. 335 Indian films were released overseas.

- Online gaming – New players, marketing efforts, specialized platforms and brand ambassadors all worked to grow the segment 34% in 2022 to reach INR135 billion. Regulatory clarity improved, and this could lead to more FDI in this segment. There were over 400 million online gamers in India, of which around 90- 100 million played frequently. Real money gaming comprised 77% of segment revenues.

- Animation and VFX – As content production resumed, service demand – both domestic and exports – increased, resulting in the segment growing 29% and crossing INR100 billion for the first time

- Live events – The fastest growing segment of 2022, organized events grew 129% over a depleted base as weddings, corporate events and activations, government initiatives, and large marquee IP with international participation took place after a gap of almost two years.

- OOH – OOH media grew 86% in 2022 and reached 94% of 2019 levels. Capacity utilization improved in 2022, but rates remained challenged. Digital OOH screens increased to around 100,000 and contributed 8% of total segment revenues.

- Music – The segment grew by 19% to reach INR22 billion. Film music, which had reduced during the pandemic, returned at scale. 87% of revenues were earned through digital means, though most of it was advertising led, there being around only 4 to 5 million paying subscribers despite streaming reach of over 200 million.

- Radio – Radio segment revenues grew 29% in 2022 to INR21 billion but were still just 66% of 2019 revenues. Ad volumes increased by 25% in 2022 as compared to the previous year, though ad rates remained 20% below their 2019 levels. Many radio companies are looking at alternate revenue streams to grow faster.

BCS Bureau