BCS Stories

COVID-19 has re-written the script of M&E sector

The script of the media and entertainment sector is getting re-written, as the content consumption patterns of consumers see a tectonic shift in a post-COVID world. While the gradual move of consumers toward OTT mediums was already underway, the lockdowns, need for social distancing, and the dearth of other entertainment avenues, accelerated this momentum.

According to a 2021 PwC report, India is currently the world’s fastest-growing OTT market, set to become the sixth largest around the globe by 2024. The market in India is expected to grow at a CAGR of 28.6 percent over the next four years, touching USD 2.9 billion in revenues.

Internet penetration in India is at about 45 percent – still low, but growing fast. And a traditional media house like Star India, so far better known for producing soap operas, is betting big on OTT. “All the shows that we are developing for Star channels are first on Disney+ Hotstar,” says Gaurav Banerjee, President, Hindi Entertainment, Star India. Evidently, OTT seems to be the future.

Though industry experts believe that currently broadcasting brings in a majority of the revenue and in the near term this may continue, things are likely to change going forward. “We see both GECs (general entertainment category) on traditional TV and OTT co-existing in the near to medium term. This is due to the fact that the penetration of television is still ~70 percent in India, also exemplified by the 30+ million users of DD Free Dish,” says Girish Menon, partner and head – media and entertainment, KPMG in India.

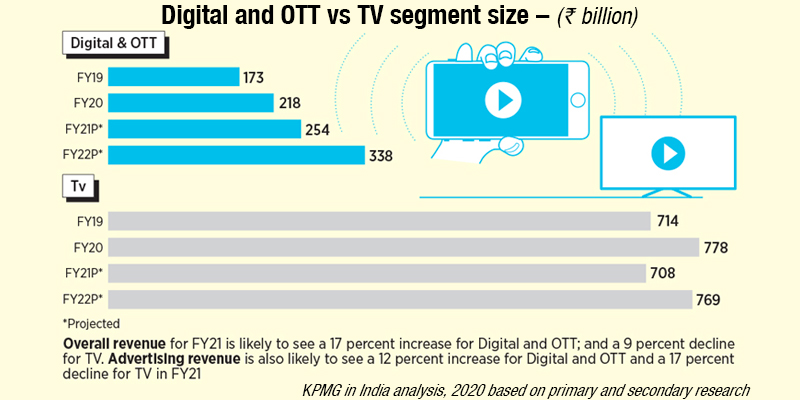

However, he adds, “India had 475 million+ OTT video viewers as of FY21 and are estimated to reach 600 million+ by FY23.” According to KPMG’s Media and Entertainment Report 2020, the overall revenue for FY21 is likely to see a 17-percent increase for digital and OTT and a 9-percent decline for TV. Currently, the Indian video OTT market is around USD 1.5 billion, and is expected to reach USD 12.5 billion by 2030, according to a report by RBSA Advisors.

Traditional broadcast business is increasingly becoming unviable. The trend is apparent going by the fact that the cable universe has seen a wipe-out of over 15 percent in the last few years. The viewership of the Hindi entertainment genre has dipped from 90 percent to 65 percent over the past few years. Similarly, the viewership of English entertainment channels has fallen from 30 percent to less than 10 percent. A large part of this dip in viewership, says former Zee executive Ashish Kaul, has happened mostly in urban markets due to factors, such as easy access to data and advent of OTT platforms. English content viewers, for instance, comprise around 5 percent of TV-viewing universe, and this segment has largely moved to consuming entertainment on OTT platforms. A couple of years ago, most broadcasters spent huge amounts of money promoting their TV shows, but today most of them are spending crores on promoting their original shows that are being streamed on their OTT platforms.

Most big-ticket show launch announcements that come from large broadcast networks, such as Zee or Star, are for their OTT platforms and not their channels.

In the US, video cord-cutting is expected to cost the traditional multichannel services nearly USD 33.6 billion in annual revenue in the next five years, according to Kagan.

The impact of the migration of consumers from big subscription services is charting a course for sales to dip from USD 91.1 billion in 2021 to USD 64.7 billion by 2025. Changing viewing patterns, only slightly moderated by rising average revenue per unit, are forecast to depress sales, excluding advertising, by 45 percent from the estimated 2016 annual peak of more than USD 116.9 billion.

Cable, direct broadcast satellite, and telcos are all feeling the impact of the shift, but the magnitude of the losses is expected to hit more acutely for DBS and telco revenue subtotals amid waning commitments by major players and relative stability from the large cable providers.

New data from Kagan illuminates the mounting flight in the US from live linear TV in 2020, a years-long trend that accelerated during the pandemic. Traditional US multichannel plumbed new depths in 2020 with a decline of nearly 7.2 million subscriptions, according to full market estimates from Kagan.

Virtual multichannel services, which provide multiple linear television channels as an OTT service, blunted the overall erosion of people taking a package of live linear channels. But the estimated 2.7 million new subscribers for these services that increasingly resemble the traditional services being displaced fell short of offsetting cable, telco, and satellite defections, Kagan says in the report.

Losses for traditional cable, telco, and satellite providers slowed in the fourth quarter. But the full-year decline underscored that the impacts of the pandemic amplified cord-cutting instead of insulating an industry built around home entertainment.

Traditional subscriptions fell by 1.5 million in the fourth quarter, which marked a slowing rate of decline. Yet the virtual segment failed to maintain its surprising momentum from the third quarter, tallying a tepid estimated gain of 223,000 to finish the year at nearly 12.5 million subscriptions.

“Americans continue to leave traditional video services in droves, with 6.8 million households cutting the cord in 2020,” said Kagan Senior Analyst, Tony Lenoir.

The shift toward consuming more and more content on OTT platforms can no longer be denied. While India continues to be an under-penetrated television market, single TV households, instead of becoming multi-TV homes, will increasingly switch to digital gadgets in the next four to five years.

You must be logged in to post a comment Login