Headlines Of The Day

India has highest penetration of gaming influencer followers

YouGov’s new gaming report shows that a quarter of young urban Indian males between 18-34 years follow gaming influencers in India. YouGov’s International Gaming Report 2021 is a three-part series on the global gaming influencer landscape. Part 1 sizes the gaming influencer global fanbase across 17 international markets and reveals where these influencer followers sit within the global influencer sector as a whole.

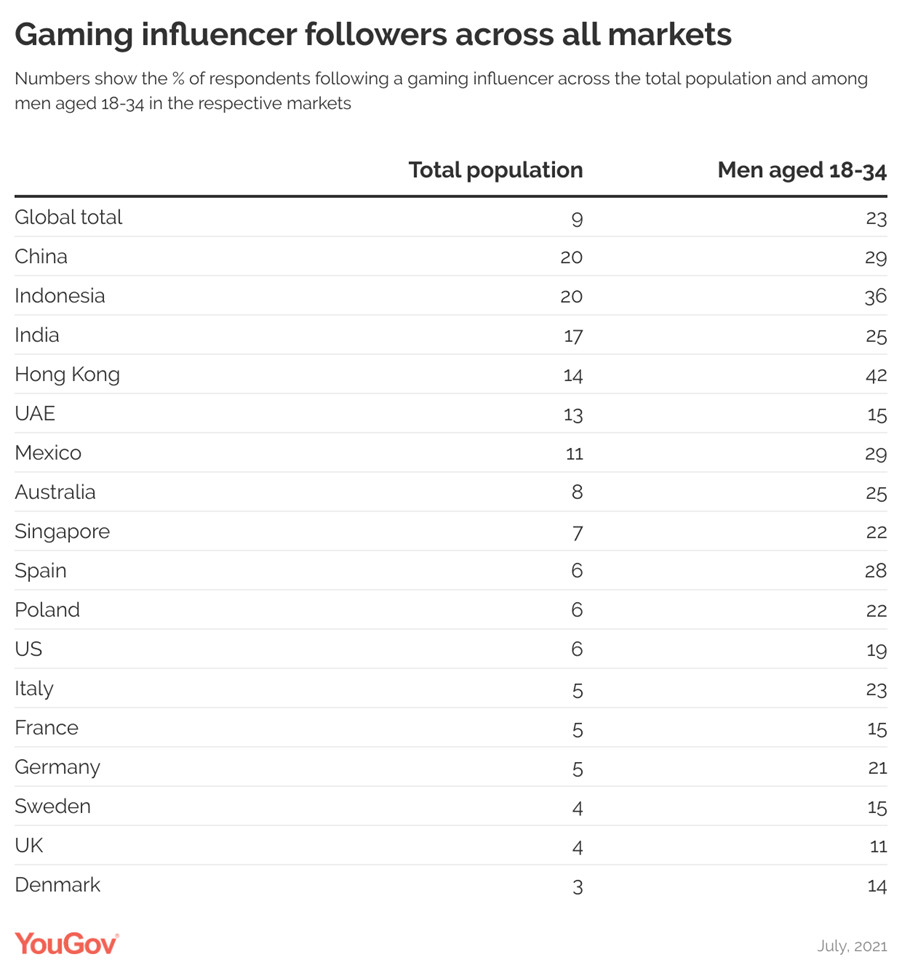

When it comes to the type of influencers followed among adults of all ages, data suggests that just under one in ten (9%) consumers across all 17 markets follow gaming influencers. However, this changes significantly when we look at different demographic groups. Globally, gaming influencers are the most popular type of influencer followed by males aged 18-34 years, with almost a quarter (23%) of all adults in this demographic segment following gaming personalities.

The proportion is higher in Asian countries, with Hong Kong (42%) and Indonesia (36%) reporting the highest numbers within this cohort.

In India, about a fourth (25%) seem to be following gaming influencers, which is higher than the proportions in the UK (11%) and US (19%).

India stands out from the rest of the world with the highest penetration of gaming influencer followers both among active gamers (25%) as well as heavy gamers (33%). India is closely followed by Indonesia and China, reporting high numbers for gaming influencer followers in both groups. The lowest numbers are reported by Denmark, where only 11% of heavy gamers & 7% of active gamers follow gaming influencers.

India stands out from the rest of the world with the highest penetration of gaming influencer followers both among active gamers (25%) as well as heavy gamers (33%). India is closely followed by Indonesia and China, reporting high numbers for gaming influencer followers in both groups. The lowest numbers are reported by Denmark, where only 11% of heavy gamers & 7% of active gamers follow gaming influencers.

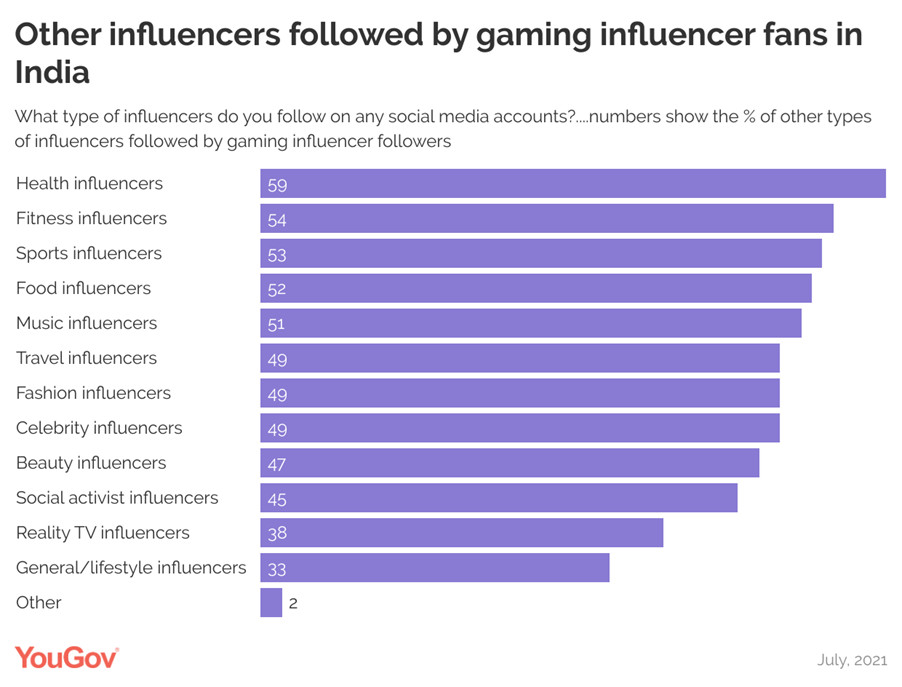

While fans of gaming influencers are heavily invested in gaming, they also have a wide variety of other entertainment interests. In India, the top ‘other influencer’ categories, followed by gaming influencer fans include health (59%), fitness (54%), sports (53%) and food (52%). This presents an opportunity for brands, advertisers, and sponsors who are keen to engage this audience through outside of the gaming landscape.

Global Insights

Piggybacking on the popularity and pervasiveness of social media platforms, influencer marketing enables brands to reach and engage with millions of consumers at pace.

New data from YouGov shows that almost half (43%) of the global population across 17 international markets surveyed now follow a social media influencer of any type. Although influencer marketing has seen dramatic growth over the last few years, demographic differences, social media usage, and other technological factors translate into varied levels of influencer following across countries.

With one of the highest internet penetrations in the world, UAE has the biggest percentage of influencer followers (75%) across the 17 markets, followed by Indonesia (73%). Looking at other markets, in the US, 29% of consumers follow influencers. In general, countries with older populations have lesser influencer followers, and penetrations of influencer followers in European countries are generally lower than in Asia. For example, in Great Britain, just over a fifth (22%) of the total population follow an influencer, and this is slightly higher in Germany (25%), and France (30%)

The growth in demand for gaming content has also driven a significant increase in the number of game streamers who broadcast content, with more and more mid-sized and micro influencers entering the scene: in Q3 2019, for example, 4.3 million channels on Twitch broadcasted live content; in Q2 2021, this number had nearly tripled, reaching 11.4 million channels (source: Stream Hatchet).

Looking across the three major gaming live streaming platforms (outside of China), audiences are consuming content from gaming influencers at a steadily rising pace. Since Q3 2019, the number of hours of live gaming content watched has more than doubled, from 3.8 billion hours to 9.0 billion in Q2 2021. While YouTube Gaming and Facebook Gaming have both seen increases in viewership, Twitch has dominated the gaming live stream market, driving nearly 7 billion viewed hours in Q2 2021 alone. Adgully

You must be logged in to post a comment Login