Reports

Media Ecosystems The Walls Fall Down

The global economy has been gaining momentum, with real GDP growth rising from 3.2 percent in 2016 to 3.8 percent in 2017 – driven by faster growth in Europe, Japan, China, and the United States of America. Growing trade, investments, and manufacturing activity have powered the global upswing since mid-2016. In contrast with the global economy, India’s real GDP growth rate declined from 7.1 percent in 2016 to 6.7 percent in 2017 – primarily on account of demonetization and implementation of GST. However, the Indian economy is already on its way to recovery as the negative impact of these two measures is fading, overall investment sentiment is improving, construction is recovering from a slump, and the farm sector is also witnessing growth. India’s real GDP is expected to grow by 7.4 percent in 2018 and 7.8 percent in 2019. The Indian economy is expected to further strengthen with around 8 percent y-o-y growth during 2020–2023. Strong and consistent economic growth fueled by a rise in consumption and growth in digitization has boded well for the Indian media and entertainment (M&E) industry which has grown at a CAGR of approximately 11 percent over FY14–18 to reach Rs 143,600 crore in FY18. The sector is expected to grow at a CAGR of 13.1 percent over the next 5 years to reach Rs 266,020 crore by FY23.

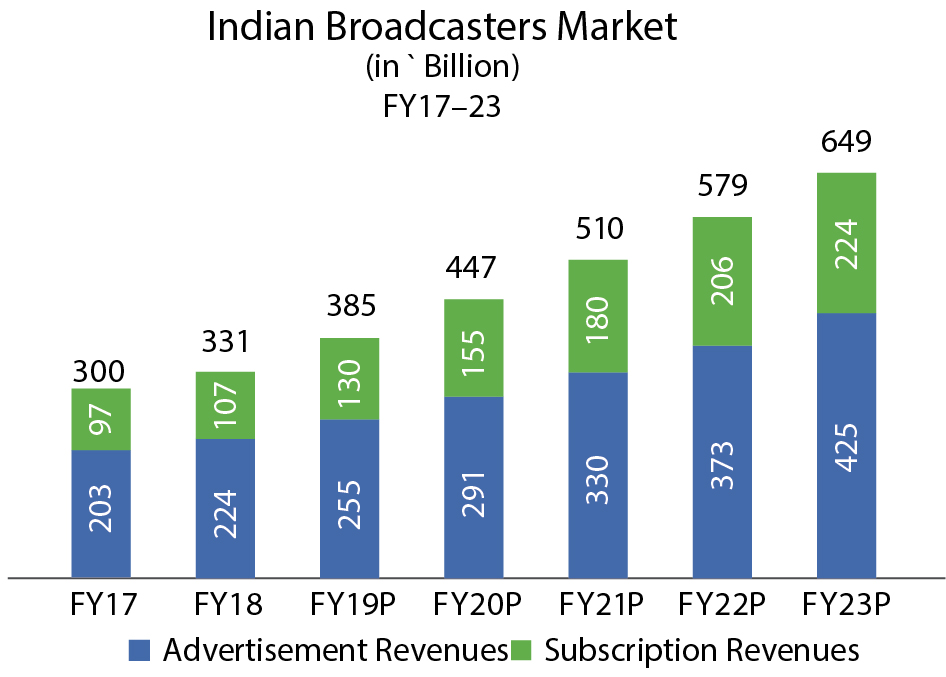

Television had a relatively subdued year in FY18, with overall revenue growing at a relatively slower rate of 9.5 percent to reach Rs 65,190 crore. Advertising revenues faced headwinds due to the implementation of GST and associated issues with compliance, and middling growth in the overall economy. National broadcasters were less impacted due to GST than the local broadcasters. Film segment revenues grew by 9.6 percent during FY18 to reach Rs 15,890 crore on the back of resurgence over the last couple of years driven by strong domestic box office performances, coupled with growing overseas contributions particularly through entry into new markets such as China. Additionally, growing revenues from digital rights are supporting the overall growth.

Digital advertisement revenues have been growing rapidly in India, and the trend continued in FY18 with a growth of 35 percent to reach Rs 11,630 crore. The Indian animation and VFX industry which has been on a strong growth trajectory clocked a growth of 18.6 percent in FY18 to reach Rs 7390 crore with a strong overseas demand for animation and VFX services as Indian players move up the value chain along with growing demand from linear TV for local animation content. VoD platforms, both global and Indian, have provided an additional impetus with demand for kids and VFX content on platforms continuing to rise, as is the improvement in production values.

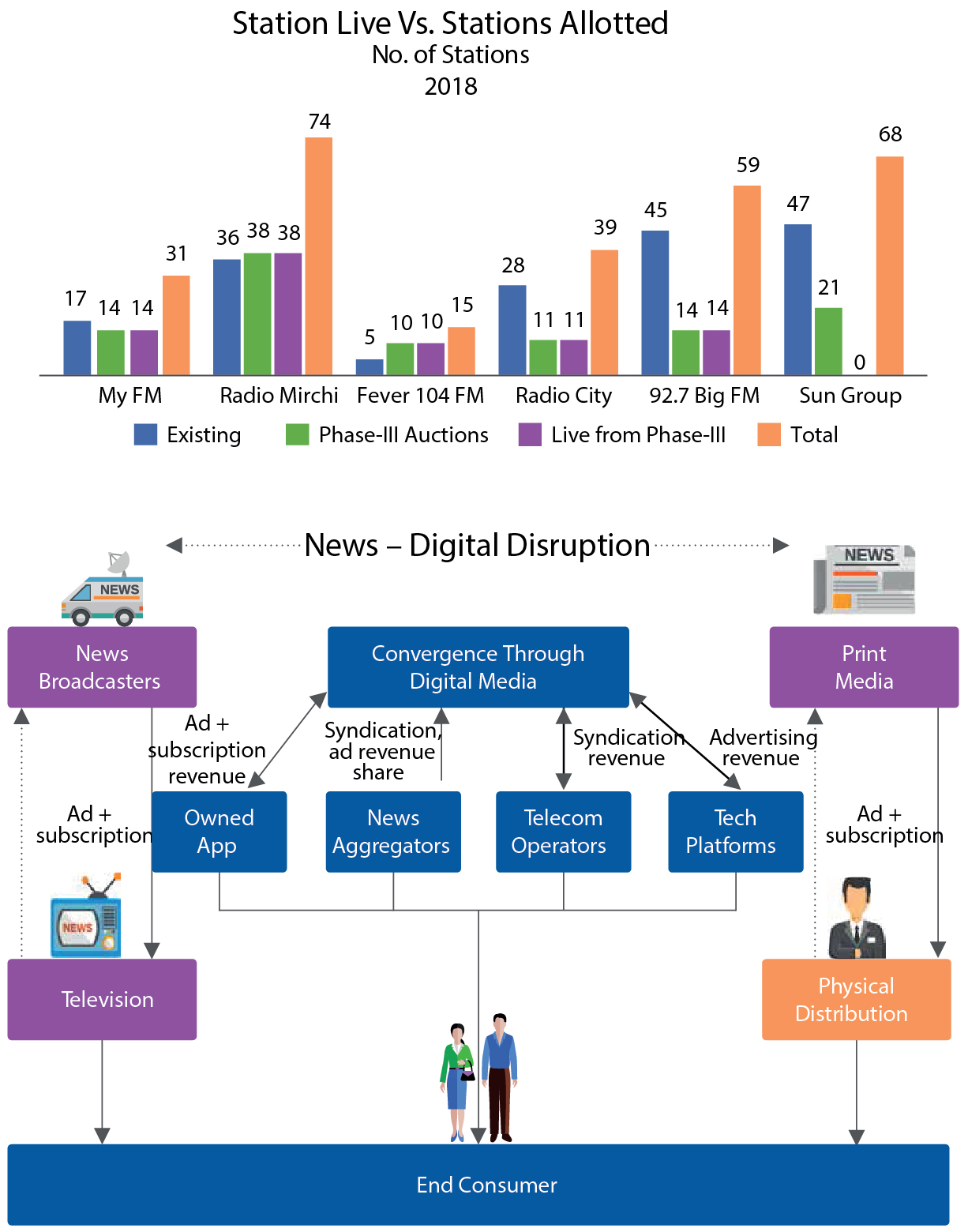

The out of home (OOH) segment grew by 11.9 percent in FY18 to reach Rs 3280 crore primarily on the back of growth in the controlled environment of the airport segment, with the segment also witnessing traction from smaller airports situated in tier-II and tier-III cities. The growth was aided by advertisement expenditures from state and central governments, e-commerce, and technology players. The radio industry witnessed muted growth in FY18 at 7.9 percent on the back of the fallout of GST rollout as local advertisement spends were significantly reduced. Over-supply from the launch of new radio stations resulted in pressure on advertisement rates which also stayed flat. The Indian music industry continued to see resurgence in recent years primarily on the back of rapidly expanding digital consumption and distribution, particularly since the rollout of 4G. Data penetration and increased use of smartphones are two key contributors toward the growing consumption of music on digital media.

Technology, media, and telecom convergence – building ecosystems

As data usage becomes ubiquitous, media consumption habits of consumers are witnessing a seismic shift. Telecom and technology companies across the world sense this as an opportunity to cater to this burgeoning digital subscriber base by building a footprint across the content part of the value chain as well. Traditional media companies have started to realize how important direct access to the digital first customer is, and have started to build out direct-to-consumer platforms. As a result, the TMT sector is witnessing a convergence in business models across the globe. To drive data consumption, telecom operators are increasingly looking at content as a differentiator, both in terms of customer acquisition and retention. Technology has also enabled content creators and TV broadcasters to transform from a predominantly B2B business into B2C business. Technology companies have also become an integral part of the media ecosystem due to their ability to reach customers directly. The boundaries between traditional and digital are likely to blur sooner than imagined. As technology becomes pervasive in everyday life, organizations that are able to smoothly merge the traditional business models, and ensure customer stickiness on their ecosystems are likely to emerge as winners in this war of ecosystems.

Over the top video consumption – reaching a tipping point

Over the top video consumption – reaching a tipping point

There has been a noticeable change in the consumption of media content in recent years with increase in both the number of online video viewing audience and the time being spent on digital media by these audiences. The online video viewing audience in India is estimated to be around 225 million in FY18, and is projected to reach 550 million by FY23. Catch-up TV, movies, and sports form a large portion of the content available across OTT platforms backed by traditional TV broadcasters, as this helps them avoid incurring additional costs for digital-only content. While the catch-up TV content is typically monetized through the advertisement VoD (AVoD) model, original content warrants the SVoD model to recover the content investments. The OTT distribution landscape also saw a change in approach with telcos being seen as an alternate and important mode of distribution to reach a wider audience base. This trend is expected to accelerate with telcos seeing usage of video on their networks as a key driver of increased data consumption.

The Indian OTT industry is currently driven by AVoD or a freemium model with SVoD still at a nascent stage with 2–2.4 million subscribers having directly subscribed to OTT platforms, in addition to ones who are considered as paid subscribers through telco-based access. While such subscription has increased in the last year, advertisement revenues have faced challenges with falling CPM rates on account of increasing ad inventory and lack of a standardized, third-party validated, digital measurement tool. Sustainable success of OTT platform is likely to be driven by engagement through quality content, resolution of standardization of measurement, and effectiveness of distribution. While the industry may experience a focus on regional language content in the near future, there is a possibility of digital video content mirroring TV content in the long-term future. As far as distribution is concerned, collaboration between OTT players and telcos is expected to be a key success factor. Lastly, monetization is likely to pick up in the medium term, through a mix of advertising- and subscription-led models.

Rural consumption – the next frontier

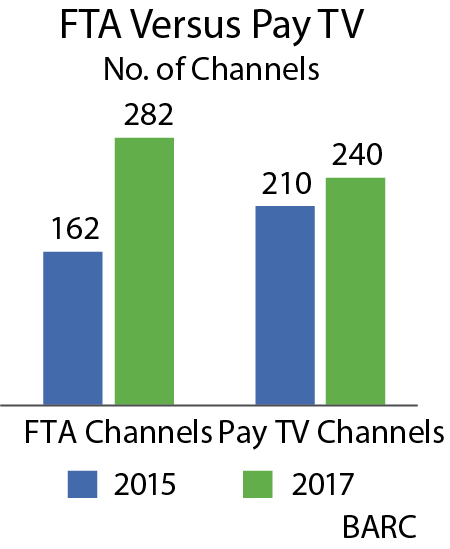

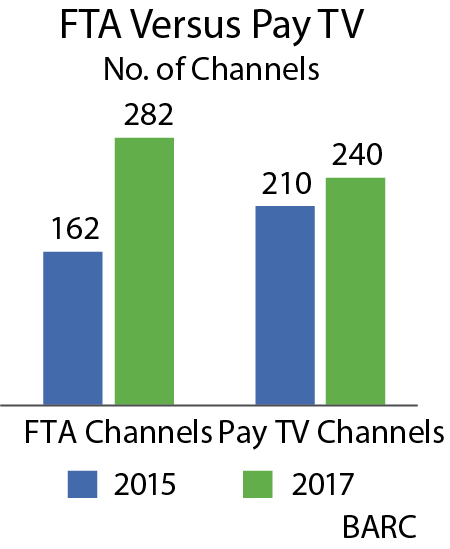

Rural India and tier-II and tier-III cities are asserting their power over the M&E sector in recent years. Television broadcasters have launched a number of free-to-air (FTA) channels to tap rural and semiurban markets; radio too has moved beyond metro cities. Listenership for non-metro areas has seen a multi-fold increase, at times even more than metro cities, attracting more brands to target rural markets. Availability of data at affordable rates increased the reach of digital platforms into rural areas driving a significant growth in digital usage and changing the demographics of digital consumption from niche to mass.

Data and analytics – every detail counts

With the advent of digital disruption, the M&E industry has gone through a seismic shift in the way content is created, distributed, consumed, and analyzed. The massive explosion of data is generating new sensitivities across the media value chain. It is thus becoming imperative for M&E organizations to grab opportunities enclosed within data with competent analytics capabilities. The industry is investing heavily in analytics-driven content recommendations, adaptive streaming, video and image analytics, data-driven journalism, and consumer analytics. A smooth amalgamation between digital and analytical solutions is transforming the sector via active audience engagement, digital experience enhancement, and content personalization, among others. Organizations are using predictive models to measure the contribution of a platform (traditional vs. digital) in the success of any program, and accordingly promoting it via the most suitable medium.

Key takeaways from Chinese M&E industry

The Chinese M&E industry has displayed impressive growth in the recent years with approximately 11 percent CAGR from 2012 to 2017. China has over 772 million internet users and a smartphone penetration of approximately 52 percent in 2017. The key drivers for the sector growth are strong economy and rise in disposable income, digital infrastructure growth, evolving revenue streams, digitalization of distribution, and rise of tier-I and tier-II cities and changing lifestyle.

The internet penetration in India currently stands at approximately 37 percent compared to about 56 percent in China. India is currently second only to China in terms of internet users. In the last 3–5 years, the Chinese digital media industry has experienced a shift from traditional ad-based revenue models to a mix of subscription and ad-based models. Compared to traditional advertisements, the ads on digital video are growing at a faster rate. India is witnessing a similar trend in shift in revenue models as Indian home grown media companies are focusing on the subscription-based model through their own platforms or partnerships with leading telecom players. While India may not follow China’s restrictive policy for limiting release of foreign films, it could work toward developing favorable policies to support growth of domestic and regional cinema. India has around one-fifth the number of screens as compared to China though it produces the highest number of films in the world at about 2000 compared to approximately 772 films produced annually in China.

Outlook

The emergence of digital media and the associated evolution of business models have started to play out in India as well, albeit India would possibly be slightly behind on the maturity curve when it comes to the shift in distribution of monies across traditional and digital media, as well as monetization from digital businesses. However, what is likely to remain in sync with global trends is the emergence of ecosystems that will try and build presence across the entire value chain, whether it is building a relationship with the end consumer, controlling the pipe that delivers content, or taking charge of the content itself. Companies cannot afford to remain straight-jacketed into traditional segments in India as well, and embrace business models that are likely to help them stay relevant in this age of ecosystems.

Based on a KPMG report – Media Ecosystems: The Walls Fall Down.

You must be logged in to post a comment Login