Trends

New report examines substantial growth in OTT ad spending and the rising rate of programmatic deals

A new report from BIA Advisory Services examines the increasing value of Over-the-Top (OTT) advertising and the current state of direct and programmatic buys. Sponsored by Madhive, the free report, The Local Programmatic Marketplace – OTT and Digital Reach Extension Channels, explores local OTT advertising trends and programmatic buying that provides access to a network of OTT ad inventory from a variety of publishers. The paper includes findings from executive interviews performed for the preparation of the paper. Participants included local TV group executives, agencies, technology solution providers, along with OTT platforms and aggregators.

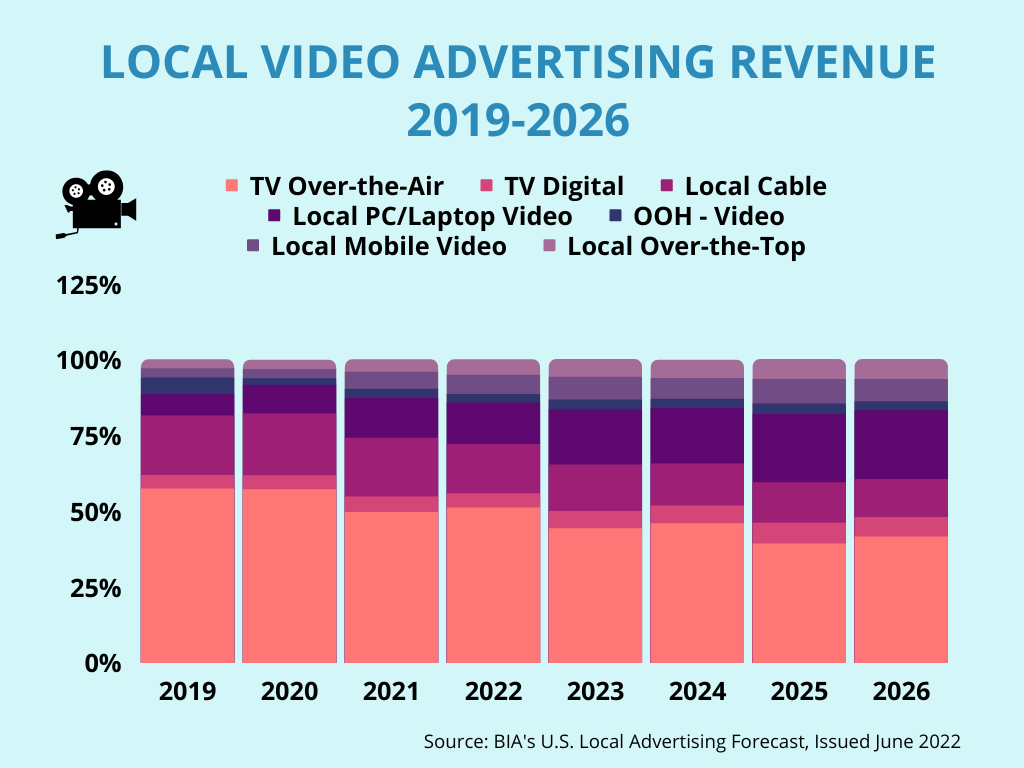

In BIA’s current edition of its U.S. Local Advertising Forecast issued in June 2022, the fastest-growing media segment is OTT with an annual growth rate of +57.4 percent in 2022. OTT spending will exceed $2.0 billion this year, drawing strength from multiple business verticals and political.

“OTT is the fastest growing channel for local media in 2022 and looking ahead to next year,” said Rick Ducey, Managing Director at BIA Advisory Services and the report’s author. “It is progressively serving as a digital reach extension to linear TV. Until recently, however, local TV and OTT have operated in silos, each with its own culture, workflow, and different levels of automation. Our research shows this is changing as marketplace trading moves to a much faster pace of innovation than in the past.”

As cited in the report, there were more than two million cord cutters in the first quarter of 2022.[1] This indicates that while local TV’s reach is still huge, it is declining as audiences shift to OTT especially among younger demos. In response, publishers are developing more ways to aggregate audiences across more types of content on local TV and OTT distribution platforms. Broadcasters want to bring both linear and digital premium video ad inventory to cross-platform buyers through programmatic trading.

As explained by Ducey, “Programmatic trading is fast becoming the new norm because it empowers data-driven automated platforms to manage real-time and forward reserve bidding that matches publisher inventory with ad buyer targeted consumer segments at sufficient scale and at mutually agreeable price points.”

Programmatic platforms extend control over premium inventory value-based pricing that serves both buyer and seller goals. Programmatic buys claim to help marketers identify and activate targeted groups at-scale across many publishers, provide critical fraud protection, as well as deliver campaign optimization, analytics, and key performance metrics. The report offers a full explanation of both direct and programmatic trading and the impact on buyers and sellers.

In terms of verticals that advertise on OTT, BIA’s U.S. Local Ad Forecast aligns with the interview findings shared by local TV group top digital executives. The automobile industry, especially Tier 1-Automotive Manufacturers and Tier 2- Local Automobile Dealers Associations, are the biggest investors in programmatic buys. As they explained during the interviews, most of these dollars are coming from Covid held opportunities. Next, Healthcare Services and Legal Services are also on the rise in programmatic advertisements. The report offers dollar spend estimates for these verticals and others on OTT. BCS Bureau