Antenna

Prospering Amid A Sea Of Change

India is the world’s second largest TV market, with nearly 190 million TV households (cable, direct-to-home, and terrestrial). Yet, there is room to grow as TV penetration is at 76 percent, out of which only 66 percent of the households have a pay TV subscription. Despite being a mature market, pay TV services continue to rapidly grow, driven by higher adoption of HD services.

From the age of a single TV and single broadcaster in the early 90s, the broadcast industry in India has now shifted to a multi-broadcaster, multi-platform, and multi-device ecosystem. The major drivers have been the rapid evolution of cable and satellite industry, growth of internet, proliferation of video viewing devices, and improved purchasing power of people. This has in turn resulted in the emergence of new business models, increased competition, changing regulations, and above all a significant shift in consumer preferences.

| Indicators

March 2018 |

| TV households – 76 percent |

| Satellite TV – 37 percent |

| Pay TV – 66.4 percent |

| Digital TV – 51.6 percent |

Digitization of TV services in India was planned in a phased manner covering metropolitan cities followed by tier-II, tier- III, and then the rest of India. Unfortunately the implementation date was revised several times over the last 7 years owing to poor infrastructure as well an inadequate number of set-top boxes (STBs). With the final deadline of complete digitization behind us by almost a year, on one hand, there are attempts by the Ministry of Information and Broadcasting (MIB) to push any remaining households toward STB adoption by issuing warnings. On the other hand, pay TV operators are gradually upgrading the consumer premise equipment with modern STBs that support advanced formats as well as HD.

Although a majority of multiple system operators (MSOs) and local cable operators claim 40 percent seeding in the final phase, there is a general lack of readiness in rural areas in terms of customer service as well as infrastructure support for technical difficulties. Demonetization in 2016 dampened the speed of seeding boxes as people in the rural areas were not equipped to make digital payments. There has been widespread migration to DTH with cheaper packages (starting at Rs 99 per month) as well as free options such as Doordarshan’s Free Dish in many parts of India. As rural consumers complain about the affordability of services as well as the upfront cost toward the STB, local operators are offering STBs at monthly instalments.

| Impact of Digitization, India

2017 |

||

| Stakeholder | Opportunities | Restraints/Challenges |

| Cable TV | Provide high quality service | High investments to convert to digital networks and digital set-top boxes |

| Offer more number of channels | Lack of clarity in revenue sharing | |

| Offer HD channels | Timely installation of STB | |

| Offer broadband services bundled with cable TV | ||

| DTH | Increase in consumer base by reach to rural India |

Acquisitions of low ARPU consumers in DAS phase-III and phase-IV |

| Broadcasters | Demand for regional content | National broadcasters need to establish themselves in regional space |

| Demand for HD content | ||

| Increase in number of channels | ||

| Increase in subscription revenue | ||

| Higher accuracy for subscriber information | ||

| Consumer | Superior picture quality | Poor communications |

| Value-added services like VOD, PPV, HD/UHD channels, 3D, DVR, and triple play services with broadband | Inability to change the current STBs | |

| Cheaper bouquets with flexibility to choose channels and pay only for a-la-carte channels |

Lack of awareness regarding online payments in rural India |

|

| Electronic program guide with channel information, program synopsis, daily schedule, and reminder options |

Inability to pay high prices for digital TV services and packages |

|

| Uninterrupted viewing during rainy condition when DTH services are affected |

||

| Frost & Sullivan | ||

Impact of digitization

Digitization has resulted in challenges and opportunities for all major stakeholders.

Market trends – Changing video viewing landscape

The video viewing landscape is evolving. Though the linear TV will still rule mass viewership trends, personalized applications and experiences will drive the market in the future.

Digitization and emergence of OTT services have resulted in the advent of new opportunities to improve penetration and expand monetization capabilities. All stakeholders want to provide quality content on multiple platforms, understand the user behavior, and monetize the content and experience. The stakeholders in the broadcast industry are leveraging new age technologies to enable this transformation.

For most leading broadcast networks in India, over-the-top distribution is the primary focus for growth for the next 3 years. They are firming up their strategies around content production (linear TV content and original content), geographic expansion (regional and international), platform expansion, and partnerships across the ecosystem to leverage the strengths of one another.

| Advanced Technologies in Broadcast, India

2017 |

|

| Television | Increase in proliferation of ultra-high definition (UHD) TV and smart TV |

| Content production | One premise cloud for storage and retrieval. Application-based content production tools for technology upgrades and streamling production to market needs |

| Targeted Advertising | Enabled by audience measurement for OTT content, server level targeted advertising is the next step |

| Set-top box (STB) | Proliferation of high definition (HD) STB adoption due to the efforts of DTH operators. Adoption of hybrid STB will gain traction with better pricing and marketing in future card-less STBs |

| Data analytics | Data used to study viewership patterns, regional traffic, language preferences with greater granularity and scale thus, enableing efficient media planning |

| Content production | Watermarking media assets not only protects them from illegal distribution but also enables seamless tracing of perpetrators |

| Immersive video | Revolutionizing conventional consumption patterns for digital advertisers, content owners, publishers across the globe, albeit at a slower rate of adoption in India. Sports and news content is already available on VR |

| Frost & Sullivan | |

| Broadcast Technology Adoption, India

2015–2025 |

||||

| 2015 | 2016 | 2018 | 2020 | 2025 |

| HDTV | UHD TV | Dynamic ad insertion | Hybrid STB | Targeted TV |

| IP-based workflows | Smart TV | Watermarking content protection | Cloud-based editing and other post production activities | Cloud-based production |

| Cloud for storage | Targeted advertising | – | Advanced data analytics | Immersive video |

| Data analytics | App-based content production | – | Artificial intelligence (AI) and machine learning (ML) | |

| Frost & Sullivan | ||||

Technology adoption trends

Advanced technologies are used in enhancing user experience, automating production workflows, monetizing content, and ensuring privacy and security of content in the multidevice, multi-platform, and multi-delivery environment.

Outlook

Hybrid TV viewing. India is characterized by a population with diverse financial, political, social, and cultural needs.

Thus, for the next 10–15 years, TV will coexist with OTT video or any other video viewing platforms. With the advent of hybrid STBs and connected viewers, TV will transcend physical boundaries and become ubiquitous across devices and screens.

Rural focus. With rural data now available from Broadcast Audience Research Council (BARC), advertisers are tapping into this market and are catering to their needs and preferences. This has opened opportunities for advertisers as well as broadcasters to segment their audiences into geo clusters and analyze their needs.

Regional content remains highly under-served, with limited channels and production of shows.

However, this rising trend is gaining precedence among producers and broadcasters, with renewed investment on unconventional, youth-centric content in vernaculars. Broadcasters need to shift their focus to cater to this audience by producing or curating more local content.

It will give them better reach and addressability with a diverse portfolio and content library.

OTT video – An undeniable service expansion

MSOs and DTH operators must examine the OTT business model to replicate and offer bundled services to their existing customers. Hathway, Sun TV, Dish TV are some of the existing OTT platforms in the market, but other market participants must follow suit to keep up with evolving consumption patterns and cater to the changing needs of their consumers.

MSOs – Service expansion on cards

MSO operators have unique opportunity to capitalize on the displaced analogue subscribers, by offering affordable digital subscriptions with easy payment options, seamless transition for first-time digital users, and value-add services to lure consumers to remain loyal to their services. Providing broadband services becomes an important part of value added services for MSOs, and therefore they pursue it themselves or will partner with internet service providers over the forecast period.

OTT providers – Catching up with the trend

Consolidation in the OTT market is expected in the next three years to pave way for higher content repository and distribution capabilities. Though advertising video on demand (AVOD) is here to stay, subscription video on demand (SVOD) will gain traction to provide high-quality content and improve ARPU.

Broadcasters – Partnerships and collaborations are the key

Content is still the king but experience is the differentiator. There will be several new partnerships and collaborations in 2018 and 2019 trying to match the consumers’ digital experience requirements.

Video viewing habits have been redefined by the OTT video ecosystem and all stakeholders are trying to create footprints across the value chain to be pertinent. Investments in advanced technologies that will enable automation, high-quality content production, and enhance user experience will be crucial. But the investments must be in line with the social, economic, cultural, infrastructure and market trends, to attain a reasonable and sustainable return on investment (RoI).

Television

The TV industry grew from Rs 594 billion to Rs 660 billion in 2017, a growth of 11.2 percent (9.8 percent net of taxes). Advertising grew to Rs 267 billion while distribution grew to Rs 393 billion. Advertising comprised 40 percent of revenues, while distribution was 60 percent of total revenues. At a broadcaster level, however, subscription revenues (including international subscription) made up approximately 28 percent of revenues.

| TV Industry – Over the Years | ||||

| Revenue by Segment | 2016 | 2017 | 2018E | 2020E |

| Advertising | 243 | 267 | 304 | 368 |

| Distribution | 351 | 393 | 430 | 494 |

| Total | 594 | 660 | 734 | 862 |

| Gross of Taxes (Rs billion) | ||||

EY estimates that while advertising is 41 percent of industry revenues today (72 percent of broadcaster revenues), it would grow to 43 percent of total revenues by 2020 (75 percent of broadcaster revenues). There are several households in India (over 30 percent) which are yet to get television screens, but, being at the bottom of the pyramid of households, would tend to move first toward free and sachet products.

The number of licensed private satellite TV channels reached 877, of which 389 were news channels and 488 were non-news channels. A total of 300 channels were pay channels, while 577 were free to air. Eleven fresh channel licenses were issued during 2017. There were 1469 registered MSOs (out of a total of 6000 MSOs), six DTH operators, two IPTV operators, one HITS operator, and Doordarshan’s Free Dish free satellite service operating in India. The number of local cable operators is estimated to be over 60,000.

Advertising revenues of large private broadcasters have grown to over Rs 20 billion from their Free Dish offerings, on the back of the fast growth of Free Dish, and increased rural weightage used by BARC. The DTH companies and 10 largest MSOs dominated the market, serving around 65 percent of pay TV homes.

John Harrison Global M&E Leader, EY

“By 2020, India is expected to become the second largest online video viewing audience globally. Driven by the exponential growth of video consumption over digital media, video OTT platforms have been a key focus area for the leading media conglomerates and start-ups alike. At present, India has over 30 OTT players, including many global players. The OTT segment in India spans companies from across the media ecosystem including broadcasters, studios, DTH operators, telcos and content aggregators. To gain a foothold in India’s highly competitive OTT segment, global players are increasingly signing content licensing deals with local players to expand their content library. They are investing in original short-form content to meet audience demand, especially from consumers of regional content (most Indian OTT users consume content in the native language). Growing digital consumption and viewership of sports on various platforms such as OTT and social networks is further increasing the overall sports audience. Over 50 million Indians are actively consuming sports content on digital. Global leagues, federations, clubs, and sports companies are also setting up their office in India to leverage the growing sports opportunities.”

DTH subscribers grew, but ARPUs were under pressure

The number of active DTH subscribers in India grew by over 3 million during 2017, primarily driven by digitization in DAS-III and DAS-IV markets. However, due to demonetization, implementation of GST, and introduction of low-value packs for rural markets and to counter the competition from Free Dish, ARPU has been flat at around Rs 220 per month as compared to the previous year, despite muted increases in package prices. Investment crunch in DTH remains as the artificial vertical integration restrictions continue despite the fact that FDI policy allows 100 percent foreign investment in such platforms.

HD subscribers crossed 10 million

As per industry estimates, HD grew with digitization and has been estimated to cross 10 million, on the back of increased sale of large television screens of 40-inch and above, where the viewing experience required higher quality content. In addition, many distributors are providing over 60 HD channels, including sports, which is a large incentive for subscribers. HD audiences contribute to higher revenues for distribution companies due to the premium pricing that such channels command.

Growth of OTT viewership poses a threat to linear distribution platforms

With the fall in broadband pricing triggered by Jio, the gap between the cost of watching an hour of TV on broadband and traditional cable or DTH has significantly reduced. Given that an average TV household watches over three hours of content a day, it is currently still more expensive to watch TV using broadband, particularly if watched on a large television screen.

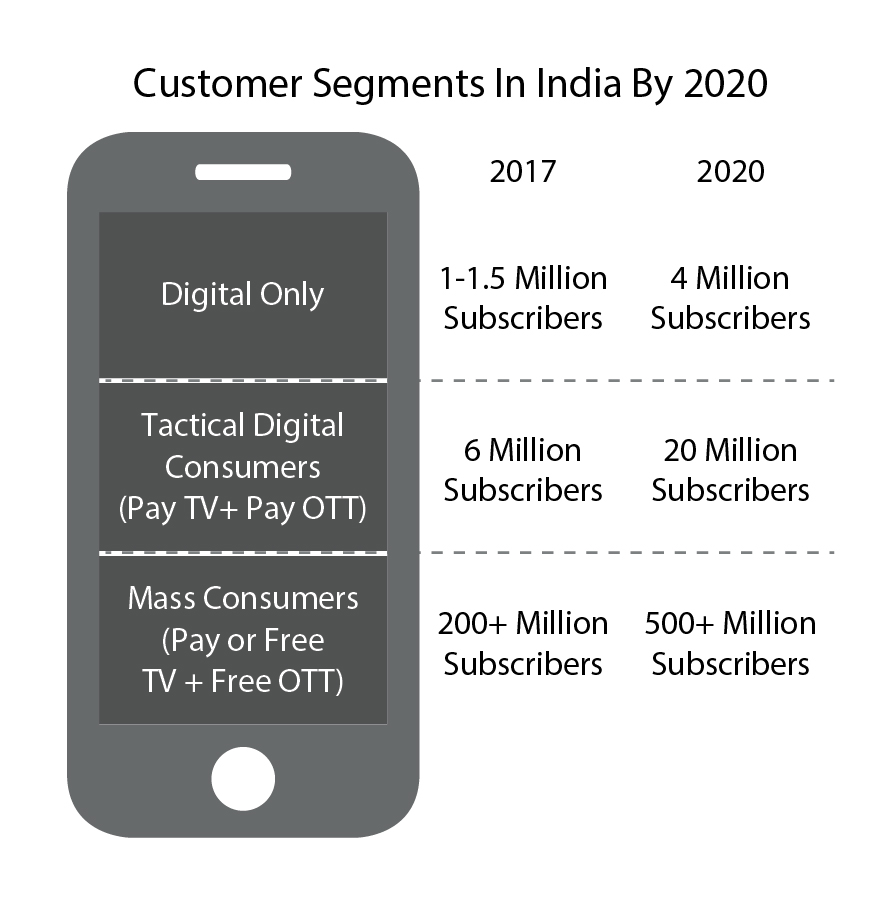

However, the fall in broadband prices could pose a threat to the cable and DTH industry. It could lead to increased viewership of TV content on larger screens, for more affluent customers, second television connections, and nuclear families, who can move to OTT platforms for their TV consumption. We estimate that by 2020, there would be around 4 million people who primarily depend on OTT platforms for their content. A number of distribution companies are investing in broadband to mitigate this risk, leading to increased ARPUs and margins.

Individual content consumption will increase

With Jio’s data packs now providing 1.5 GB per day for around Rs 5, viewers can watch their specific and preferred content at ease, on their smart phones. This would include content that they otherwise would not be able to watch on a common television set in the house, or content that they can now consume while on the go. This viewership is incremental to television, and provides an opportunity for advertising revenues. With the launch of low-cost smartphones by Jio and Airtel in the sub Rs 2500 range, consumption through OTT could take place across different audience segments.

Broadcasters have also witnessed growth in subscription revenue

Broadcasters’ subscription revenue increased from Rs 90 billion in 2016 to Rs 99 billion in 2017. The growth in subscription income was a result of long-term contracts with escalation clauses, digitization of TV households, and increased transparency. Many broadcasters initiated subscriber audits to validate their revenues as declared by distribution companies. International subscription revenues faced stagnant rates due to increased number of bouquets being offered to consumers. International subscription revenues remained stable, and accounted for around Rs 20 billion in revenues in 2017.

Free TV continued to grow

DD Free Dish, the state-run DTH provider, is the largest TV distribution company in the country with over 24 million estimated subscribers. This is considerably higher than large national pay TV companies, which average 8 million to 16 million each. With over 80 channels currently, DD Free Dish plans to eventually reach 256 channels by 2020. The implementation of the Tariff Order of 2017 could further push the Free TV viewer base to 46 million by 2020. One of the key drivers for the growth of Free Dish was the overlap in the content played by leading broadcasters on their FTA and pay channels. The content played on the FTA channel was as recent as 1 to 3 months in certain cases. The key genres on Free Dish include GECs, movies, and news. Star has launched a channel with exclusive GEC content for Free Dish, as well as a sports channel, Star Sports First. Broadcasters have now limited the quantum of recent content from their pay channels to Free Dish, after pressure from DTH and MSOs forced them to take this move. There is also a move to remove private pay channels from Free Dish, to protect ad revenues and viewership of Doordarshan’s channels, which is a matter that is currently being debated.

HITS launched with some scale

Hinduja Group’s NXT Digital is the only operational HITS operator in India. In year two of its operations, it has managed to achieve a customer base of 1.5 million subscribers, and is available in eight states. HITS business model enables thousands of entrepreneurial cable operators from across the country to make a transition from analog to digital while still holding on to their customer base, and provides a viable option to LCOs who need to digitize.

Digital media

Digital media has grown significantly over the past few years. The rapid up-take of connected devices, especially smartphones and tablets, is instrumental in media consumption shifting beyond traditional media formats such as broadcast and cable TV toward digital media. The broadband subscriber base grew significantly in 2017 to reach 363 million in 2017. The growth of connectivity resulted in the proportionate growth of internet users to 481 million in 2017, of which 295 million were in urban areas and 186 million in rural areas. Subsequently, 250 million people viewed videos online in 2017, a growth of 64 percent over 2016. The number of music streaming users in 2017 was 87.6 million. Key players included Google, Apple, Gaana, Saavn, SaReGaMa, Wynk, Hungama, and Jio Music.

| Digitization Resulted In Increased Customer ARPUs | |

| Phase | Customer ARPU Range In Rs Gross Of Tax |

| I | 250–350 |

| II | 200–325 |

| III | 150–225 |

| IV | 125–200 |

Digital subscription comprising video and audio streaming subscription income grew 50 percent in 2017 to Rs 3.9 billion, and this growth promises to continue unabated till 2020. The video subscription ecosystems have matured, and there are over 30 video OTT platforms in India.

| Increased Collections From End Customers Resulted In Increased Revenues | ||

| Stakeholder | Before Digitization (%) | After Digitization (%) |

| Consumer ARPU | 100 | 100 |

| LCOs | 65–80 | 45–55 |

| MSOs | 10–20 | 15–25 |

| Broadcasters | 10–20 | 20–30 |

| EY Analysis | ||

With these developments, telcos could turn competitors to broadcasters. Currently, Jio acts as an aggregator of content of all major broadcasters. Now, these services are offered free but Jio could start charging from next year or bundle with data packages. Over time, other telcos may follow suit to increase the yield on their network. This would enable them to sell both bandwidth and content, including their own channels or other OTT channels.

Vodafone, Reliance Jio, and Airtel have already launched their own OTT services. Vodafone has developed its own OTT platform: Vodafone Play, Airtel has launched Wynk Music, and Jio has launched Jio Movies. These players are providing subscription in the form of a bundled plan with data services. BSNL partnered with Eros Now to bundle and launch Eros’s offerings across existing and new data users of BSNL, in association with SpeedPay, its multi-purpose offline wallet. BSNL also partnered with ZEEL’s Ditto TV, whereby the OTT service will be available to BSNL data subscribers. Idea also partnered with Ditto TV and provides 90+ live channels to users.

Radio

The Indian radio segment grew by around 6.5 percent in 2017. Key drivers remain a large youth population, growth in the quality and quantity of film music on the radio, and built-in FM receivers in most handphones sold in India. Also, radio is a free medium, and free offerings will always find a place in the entertainment mix of most Indians.

Growth has been volume-driven. Phase III saw the launch of 162 new FM radio stations, including across the key markets of Mumbai and Delhi. Licenses were acquired in 17 cities that had no operating FM licenses. New stations in existing cities and proliferation of private radio to smaller cities are likely to increase the listener base. These launches created an increase in the volume of inventory available, which was one the main reasons for the growth in industry revenues.

Revenues remained heavily skewed toward larger cities. Around 60 percent of the radio segment’s revenues are generated by the top 10 cities. Effective rates in metros can be over 10x the rates of smaller cities. Station bouquet sales are increasing, as radio is now able to provide a deeper reach in many states. It is becoming a suitable reminder medium and an alternative to print, which is reflected by the number of print companies that also own radio stations.

| Digital Media Revenues

Rs Billion |

||||

| Segment | 2016 | 2017 | 2018E | 2020E |

| Advertising | 89.2 | 114.9 | 145.5 | 203.6 |

| Subscription | 2.6 | 3.9 | 5.7 | 20.1 |

| Total | 9.8 | 118.9 | 151.2 | 223.7 |

Smaller stations provided a cost-effective option for local advertisers. The share of local advertising in the radio market has increased from 20–30 percent in the early 2000s to up to 60 percent currently. Radio’s key proposition is that it caters to the local market, allowing advertisers to target specific markets (unlike TV). This also allows radio companies to garner better pricing, as local advertisers’ budgets are of smaller ticket sizes.

Transit radio saw a beginning. Companies are looking at airports, railways, and metros as mediums to expand the reach of radio.

Music Broadcast Ltd. (Radio City FM) partnered with Lucknow Metro Rail Corporation (LMRC) to entertain travelers and develop travel entertainment as an independent vertical

Sun Group (Red FM) is exploring potential partnerships to provide on-board entertainment to passengers, after a brief stint with Shatabdi trains (New Delhi to Kalka) in 2016

Entertainment Network India Ltd. (Radio Mirchi) has partnered with Delhi International Airport since 2015 to set up a custom-produced 24×7 airport radio station

FM auctions received a tepid response. The year also marked a tepid response to batch-II of phase-III auctions of radio frequencies by the Government of India. Out of a total of 266 radio frequencies across 92 cities put up for auction, only 66 frequencies in 48 cities got sold to 11 companies. The second batch witnessed the participation of 14 companies compared with 28 companies that took part in the first batch. Some of the reasons for the lower participation in the auction can be higher migration fee, delay in operationalization of the newly acquired frequencies, and high reserve price. Overall, the players focused on consolidating their operations in the current locations as against aggressively bidding for new radio frequencies in typically radio-dark cities. The government’s receipts from batch 2 of the auctions were Rs 2020 million as against Rs 11,600 million earned from the batch-I auction conducted in 2015. ENIL and Sun TV Network emerged as the largest acquirers in the auction. While ENIL acquired the highest number of frequencies (21 frequencies) with a total spend on Rs 513 million, Sun TV Network emerged as the highest spender by acquiring 13 frequencies at a spend of Rs 805 million, which included the two costliest frequencies: in Hyderabad for Rs 234.3 million and Dehradun for Rs 156.1 million.

Continuing its drive to increase the penetration of radio across the Indian geography, in December 2017 the cabinet gave its approval for the e-auction of batch-III of private FM radio phase-III. Under this batch, the government is expected to auction 683 radio frequencies in 236 cities with a potential to generate a revenue of Rs 11,000 million. The roll-out of the third batch is expected to target majorly those cities that have no existing private FM radio channels, which include several cities in the border areas of Jammu and Kashmir and Northeast states, where the population is less than 1 lakh.

Consolidation, finally. Several deals have been witnessed in radio, including the following:

Essel group has entered the FM radio space by acquiring a 49 percent stake in Anil Ambani’s radio company. It has the option to buy out the remaining 51 percent after the three year lock-in period, subject to approvals

Jagran Prakashan Limited has acquired Music Broadcast Ltd. which operates 39 FM radio stations under the Radio City and Radio Mantra brands

ENIL, which had previously agreed to acquire seven Oye FM radio station from TV Today, will not be acquiring three Metro FM radio stations after the MIB disapproved its sale

BBC World Service launched 11 new language services, including four Indian languages – Telugu, Gujarati, Marathi, and Punjabi. The company introduced the new languages across radio, TV, mobile and its web content, taking its total language count to 40 from 29

M&A activity

The Indian M&E sector witnessed a relatively new trend in deal activity with emerging segments such as gaming and digital gaining momentum, while the deal activity in the traditional media segments was slower. The slowdown can be partially attributed to challenges faced by the advertising segments of the industry due to demonetization and GST.

Overall, the number of transactions in the M&E sector decreased from 56 deals in 2016 to 40 deals in 2017. Further, the total deal value was also lower at USD 1261 million in 2017 compared to USD 2863 million in 2016.

The sharp fall in deal value was due to the absence of megadeals during the year, unlike 2016, which saw transactions such as the Dish TV–Videocon d2h merger worth USD 1.2 billion and the sale of Ten Sports Network by Essel group to Sony Pictures for USD 385 million.

The latest advancements in technology/digital are already having a significant impact on the entire media value chain, especially on the way media and content are being consumed and distributed. As a result, consolidation and investment in digital continued to remain the key underlying themes across the various industry segments.

Television. The largest sub-segment in terms of deal size was led by transaction in the TV distribution segment. However, the activity in the TV broadcasting space remained muted. The deal activities witnessed a mix of initial public offerings, private equity, and strategic transactions.

Television distribution. The industry has transformed after the cable TV digitization amendment bill was passed in 2011, which mandated an all-India switchover of analog cable TV networks to digital addressable systems in four phases. This has resulted in significant CapEx requirement for the DTH and cable companies. Despite the deadline for phase IV cable digitization having passed, the industry continues to seed STBs-top boxes for fulfilling rural requirements. This continuous requirement of capital has resulted in significant consolidation and investment in the sector over the last few years. EY believes the three major transactions this year are a continued reflection of these trends:

Private equity major Warburg Pincus acquired a 20 percent stake in Bharti Airtel’s DTH business Bharti Telemedia, which operates under the brand Airtel Digital TV, for Rs 22,400 million in December 2017. The PE player will acquire a 15 percent stake from Bharti Airtel and the balance from another Bharti entity. The proceeds will be used by Bharti Airtel to reduce its debt and strengthen its position in telecommunications

In November 2017, Reliance Communication Ltd., part of the Reliance ADA Group, entered into a binding agreement to sell its DTH business, Reliance Big TV Ltd., to Pantel Technologie;

In July 2017, GTPL Hathway underwent a public listing where it raised Rs 4848 million, including primary issue of Rs 2400 million the majority of which was to be utilized to repay/pre-pay the borrowing availed by the company; and

In addition, there were a few smaller transactions where MSOs like GTPL and Den Networks consolidated their positions to the last mile by increasing their stake in their respective subsidiaries/JVs.

The year also saw MIB accepting the recommendation of Inter-Ministerial Committee (IMC) to continue with the existing cross-holding restriction in the guidelines for DTH operators. As per the guidelines, a broadcasting or cable TV company cannot hold more than a 20 percent stake in a DTH company and vice versa. Any relaxation in such cross-holding guidelines in the future can result in increased deal activity in the TV distribution segment.

Television broadcast. The segment continued to witness low volumes of deal activity despite the TRAI guidelines on tariff order and interconnect regulations. Given the requirement to have subscription packages within the same broadcast network, there was expectation of national players acquiring smaller niche players or regional players to have a wider channel pool to create subscription packages for consumers. However, there was only one deal in the segment with Zee Entertainment Enterprises’ acquisition of 9X Media Pvt. Ltd. and its subsidiaries for Rs 1.6 billion in October 2017. 9X Media operates a bouquet of six music channels, which have a leading market share in their respective segments.

The activity in the news genre remains muted on account of the FDI restrictions in this sector. Any increase in the FDI limit in news and current affairs TV channels is expected to pave the way for increased investment in this segment from global strategic players.

Radio. The industry faced a slightly muted year on account of the pressure faced by the industry due to a slowdown in advertising spend on account of demonetization, implementation of GST, and implementation of RERA in the real estate sector.

While the industry did not witness any significant deal activity, the year witnessed a successful public listing of Jagran Prakashan-promoted Music Broadcast Limited, which operates a network of 39 FM stations in 39 cities under the brand of Radio City. The company raised approximately Rs 4885 million by way of primary issue of Rs 4000 million and an offer for sale of Rs 885 million.

Going ahead, the industry may witness an increase in M&A activity with large media groups looking to acquire regional/smaller radio networks, with the lock-in on license migrated under the phase-III regime expiring on March 31, 2018. Moreover, any relaxation in the FDI limit, from the current 49 percent will result in further investment by global strategic players in the Indian radio market.

There is a sea of changes poised to impact the way the broadcasting industry operates. Moving forward, new technologies such as blockchain, AI and ML, process automation, cyber security, and analytics will have a major role to play.

This article has relied majorly on two reports, FICCI-EY report, Re-imagining India’s M&E Sector and an exclusive whitepaper by Frost & Sullivan, Outlook for Indian Telecom & Broadcast Industry.

You must be logged in to post a comment Login