Trends

Semiconductor shortage-preparing for the future

Construction plans are underway for new semiconductor fabs to address the current microchip shortage and future demand for Artificial Intelligence, 5G, the Internet of Things and other emerging technologies. At the same time, industry professionals understand the need to not oversaturate the market with new inventory, and manufacturers are working for a balance between new 200mm and 300mm technology and supporting older technology and geometry process nodes.

Foundries and chip manufacturers have started planning for 29 new semiconductor factories. These high volume fabs are located mainly in China and Taiwan, followed by the US, Japan, and Korea. For 300mm technology, 14 fabs broke ground and started construction in 2021. In 2022, 10 new fabs broke ground or are slotted for construction before the end of this year, and another 13 fabs are planned to break ground in 2023. It takes 1-2 years to complete construction and another year to install equipment and readiness for wafer starts, so the industry expects 200 fabs operating on 300mm technology by 2026. Although not a quick process, it is a necessary one to ease the current market turbulence.

Projected High-Volume Fabs Starting Construction, World Fab Forecast Report, 2Q 2021, Published by SEMI.

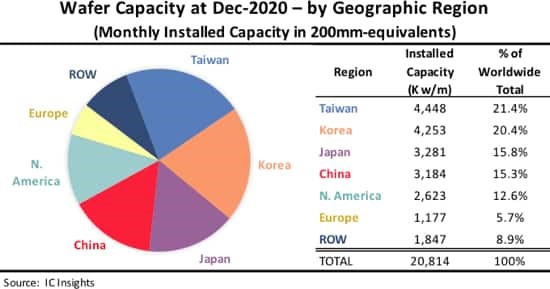

While most manufacturers have divested packaging and assembly locations, 80% of semiconductor fabrication sites are located offshore, mainly in Taiwan, Korea, Japan and China. As of 2021 all sub 10nm geometry process node fabs are located outside of the US; however, manufacturers are beginning to put a restored focus on reshoring in the US. This has also been backed by the recently passed CHIPS and Science Act of 2022 in the US Congress.

There is a separate set of challenges associated with building new fabs. Construction materials and labor to build the fabs are in short supply and causing delays in completion. Fabs that began construction in 2021 are now experiencing issues acquiring semiconductor manufacturing equipment due to increased demand for such equipment. Complex semiconductor chips such as microprocessors, high end microcontrollers and Field Programmable Gate Arrays (FPGAs) are required components of fab equipment, and these are in short supply due to the current chip shortage. Lead times on fab equipment have extended to 10-14 months, and for some components lead times are 2 years. The semiconductor manufacturing equipment market makes up for a small fraction of sales when compared to the automotive or IT industry – but this equipment is critical to building more fabs and expanding capacity for chip production. Ensuring semiconductor chips are allocated to this market segment is necessary to expand wafer capacity and meet the growing demand.

Tools for Solving Supply Chain Issues. As the market catches up, industry practitioners are under pressure to solve challenges today. Fabs are costly to build and take years to produce semiconductors after breaking ground. Chip manufacturers need to expand capacity without oversaturating the market. And demand grows: electric cars, data storage, and wireless industries are positioned to be the next big market segments for semiconductors. If the current global supply chain shortages extend into 2024, businesses need tools for supply chain risk management. And supply chain issues need to addressed now! IHS Markit, S&P Global