Headlines Of The Day

Streaming giants to benefit from India’s mega multiplex merger

The pending merger of India’s top two multiplexes, PVR Ltd. and INOX Leisure Ltd., is about building a better theater business, but it will also help India’s burgeoning streaming services.

In March, PVR and INOX agreed to merge to create a network of 1,546 screens across 109 Indian cities. The deal, with a transaction value of $1.22 billion, will create the largest entertainment company in the country.

It will also help India’s streaming platforms access much-needed local movie content, analysts say. Acquiring unique content has been key to the streaming companies’ strategy to carve out market share in the country. Movies play a big role in this strategy as India is one of the world’s largest movie producers.

“The wider footprint [of the merged cineplexes] should help over-the-top players to better judge a fair value for movie purchases based on their individual box office performances and predict how future content made by the same content producers will perform in terms of viewership,” said Aasim Bharde, vice president at DAM Capital Advisors.

Streaming giants such as Netflix Inc. and Walt Disney Co.’s Disney+ Hotstar may also see more small- and mid-budget film producers head straight to their platforms, where they will have “better negotiating powers vis-à-vis PVR-INOX,” Bharde added.

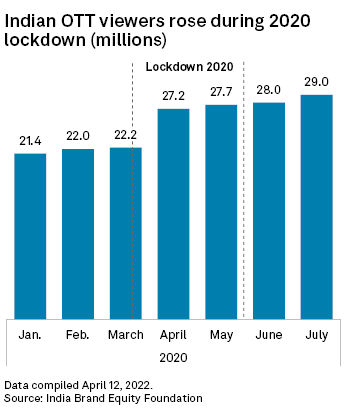

India’s streaming landscape is heavily crowded, with over 40 subscription and ad-based video-on-demand players, including foreign and local names. The market is highly price sensitive and players face heavy competition from other entertainment avenues such as cable television and cinemas.

The biggest subscription video-on-demand player by market share is Disney+ Hotstar, followed by Eros Now and Amazon.com Inc.’s Prime Video, according to Kagan, a media research group within the TMT offering of S&P Global Market Intelligence.

Access to content

The merger’s larger theater footprint will help streaming players better assess what movies to show to their audiences.

“A wider screen footprint should ideally drive higher box office revenue that accrues to content producers. This should mean that content producers continue to remain financially healthy and produce content, most of which would eventually land on OTT platforms,” Bharde said.

The film sector was one of the worst affected by the COVID-19 pandemic, and the merger is important for the “long-term survival of the film business and [to] fight the onslaught of digital OTT platforms,” PVR Chairman and Managing Director Ajay Bijli said in a filing to the Indian exchange.

INOX and PVR did not respond to Market Intelligence’s request for comments.

Needing each other

Even as cineplexes and streaming players continue to battle for subscribers, they will need each other to survive, analysts said.

OTT players prefer big-budget movies to release in theaters before they are shown on their platforms as it can lower their marketing spends relatively, said Vivek Menon, founding partner at Indian media and entertainment fund NV Capital.

During the pandemic, when cinemas were shut, several movies went “digital-first” and launched directly on streaming platforms. For example, Bollywood’s Dil Bechara had its biggest opening on Disney+ Hotstar, garnering a reported 95 million views in the first 24 hours of its release in July 2020, according to a Hindustan Times report.

That strategy would have required streaming platforms to spend heavily on marketing. “A couple of years back, Netflix and Amazon had yearly marketing budgets of around 3 billion Indian rupees. The budgets will have gotten bigger since there is a war among all the leading OTT platforms to acquire compelling content,” Menon said.

Amazon Prime Video did not respond to Market Intelligence’s request for comment on its marketing spends. A spokesperson from Netflix declined to comment.

Most streaming platforms continue to market their content through a slew of different methods. For example, Netflix’s India marketing campaign for the fifth season of Spanish crime drama Money Heist in December 2021 included a multi-starrer digital video featuring fans and a collaboration with Pepsi and Bollywood star Tiger Shroff.

Still, Indian consumers remain somewhat resistant to the idea of paying for TV content, due to the proliferation of free and ad-based video-on-demand services.

In addition, streaming platforms are up against an audience that heavily prefers going to movie theaters in India. Since theaters reopened in October 2021 following a deadly second COVID-19 wave in April last year, both INOX and PVR have raised their average ticket prices, or ATPs. INOX and PVR saw a 48% and 36% jump in ATPs on a quarterly basis to 226 rupees and 239 rupees, respectively, according to their results for the fiscal third-quarter ended December 2021.

Smaller budgets, bigger gains

The merger could also attract more smaller-budget film producers to choose OTT players for screen time over multiplexes. These filmmakers would rather sell to a streaming platform, where they can get better value for their content, said Menon.

“Smaller-budget movies, made in the range of 10 million to 20 million Indian rupees, with new actors and bold content will not go directly to theaters such as the merged INOX and PVR as it is not commercially viable,” Menon said.

One example is Bollywood movie Toofaan, a mid-budget movie picked up by Amazon Prime Video in 2021. Released directly on the platform, Toofaan topped the streaming giant’s most-watched list in its first week of release. This trend of smaller-budget movies releasing directly on streaming platforms is likely to gain traction.

Multiplexes usually have the upper hand when it comes to negotiating a revenue share agreement with film producers as there is no cap on the box office revenues grossed in cinemas.

The soon-to-be merged INOX-PVR cineplex will have better bargaining power for revenue share agreements, show times and even the window between theater and OTT release with content producers due to its sheer size, Jinesh Joshi, research analyst at Prabhudas Lilladher, said.

That could encourage more small- and mid-budget producers to consider OTT platforms for releasing their films.

Theatrical windows, which refers to the period between a film’s release in a theater and its release on other mediums such as streaming platforms, shrunk from eight weeks to four weeks for local films during the 2020 pandemic.

BCS Bureau

You must be logged in to post a comment Login