International Circuit

Taiwan semiconductor is expanding its global production footprint

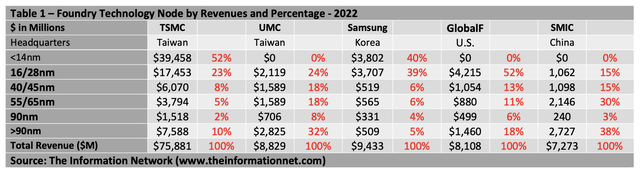

Taiwan Semiconductor Manufacturing Company’s dominated the semiconductor foundry industry Between Q1 2019 and Q4 2022 – revenues from the 3-10nm nodes have been increasing, and in 2022 represented 52% of total revenues. TSMC’s share of the global pure-play foundry market currently stands at 58.5%.

In competition with Samsung’s business, TSMC is a clear winner based on revenue at the 3-10nm technology nodes, as shown in Chart 1, according to The Information Network’s report entitled “Global Semiconductor Equipment.

Against other foundries such as United Microelectronics (UMC), GlobalFoundries (GFS), SMIC, clearly TSMC dominates the small node segment.

TSMC’s shipments (blue column) between Q1 2018 and Q4 2022. It shows nearly consistent QoQ shipment growth and illustrated by the trendline (dotted line). Shipments decreased slightly in Q4 2022 tied to a slowdown in PCs and Smartphones. ASPs (average selling prices) nevertheless increased in Q4 2023 as demand for small node chips continues, particularly at 3nm.

Strong Growth of 3nm Demand

I forecast 3nm revenue to start production in 2023 and represent 24% of the sub 7nm segment, as 7nm drops to 28% and 5nm to 48% of the $36 billion segment. Key customers for the 3nm node are Apple’s A17 (iPhone) and M3 (“Mac”) processors. Note that TSMC’s first-generation N3 node will be used for primarily by Apple. TSMC’s second-generation N3E will feature an improved process window, resulting in faster time to yield, increased yields, higher performance, and lower power. The N3E node should begin production in 2H 2023.

Chips Acts and New Fabs

TSMC continues to expand capacity by building fabs. The U.S. Chips Act is providing $50 billion in handouts to chip companies to make chips in the U.S. toward fab construction costs.

Importantly, there are nine regional Chips Acts across the globe, so this imbalance between capex and WFE is a worldwide issue.

- TSMC is building fabs in the U.S. state of Arizona that will make chips using the 4 nanometer and 3nm processes, with mass production scheduled to begin in 2024 and 2026.

- TSMC is also building two fabs in Japan, using the company’s 12nm, 16nm and 22nm processes as well as 28nm specialty technology, with commercial production expected to start in 2024, and a 5nm and 10nm fab in 2025

- TSMC has chosen Dresden, the semiconductor hub of Germany, as the location to construct a fab with production scheduled to start in 2025.

Chat GTP and Generative AI

The popularity of generative AI Chatbot ChatGPT has been increasing, and in the first five days after its release, 1 million users signed up, according to a Dec. 5 tweet from co-founder Sam Altman.

A key growth catalyst for TSMC is that ChatGPT runs on NVIDIA’s A100 and H100 processors and TSMC makes the A100 and H100 with its 7nm and 4nm processes, respectively.

While ChatGPT is the sweetheart of the generative AI market along with its chip suppliers NVIDIA and SK Hynix being the greatest beneficiaries, there are other developments that represent an opportunity for TSMC as several other companies are moving to their own Chatbot services. These include:

- In February 2023, Google began introducing an experimental service called “Bard” which is based on its LaMDA AI program.

- China’s Baidu (NASDAQ:BIDU) is also developing an AI-powered chatbot similar to ChatGPT called “Ernie bot,” expected to launch next month.

- Microsoft said it would integrate ChatGPT access via its Azure cloud “soon,” but did not give a specific date.

- The South Korean search engine firm Naver announced in February 2023 that they would be launching a ChatGPT-style service called “SearchGPT” in Korean in the first half of 2023.

- The Russian search engine firm Yandex announced in February 2023 that they would be launching a ChatGPT-style service called “YaLM 2.0” in Russian before the end of 2023.

These alternatives have their hardware options, including Google Tensor Processing Units (TPUs); AMD Instinct GPUs; AWS Graviton 4 chips; and AI accelerators from startups like Cerebras, Sambanova, and Graphcore.

But so far, few of these new chips have taken significant market share. The two exceptions to watch are Google, whose TPUs have gained traction in the Stable Diffusion community. SeekingAlpha