Company News

Tencent faces possible record fine for anti-money-laundering violations

Chinese technology giant Tencent Holdings Ltd. TCEHY -3.29% is facing a potential record fine for violations of some central bank regulations by its WeChat Pay mobile network, as Beijing toughens its regulations for fintech platforms, according to people familiar with the matter.

Financial regulators recently discovered that WeChat Pay had flouted China’s anti-money-laundering rules and had lapses in compliance with “know your customer” and “know your business” regulations, among other things, some of the people said. Tencent’s ubiquitous mobile payments network was also found to have allowed the transfer and laundering of funds with illicit transactions such as gambling, the people added. For WeChat Pay, “know your customer” and “know your business” procedures mean it must verify the identities of users and merchants transacting on its platform and the source of funds for those transactions.

The People’s Bank of China, the country’s central bank, uncovered the breaches during a routine inspection of WeChat Pay that concluded in late 2021, the people familiar with the matter said. The size of the fine is still under deliberation and it could be at least hundreds of millions of yuan, some of the people said. That would be much larger than the fines regulators typically imposed on nonbank payment companies for anti-money-laundering rule violations in the past.

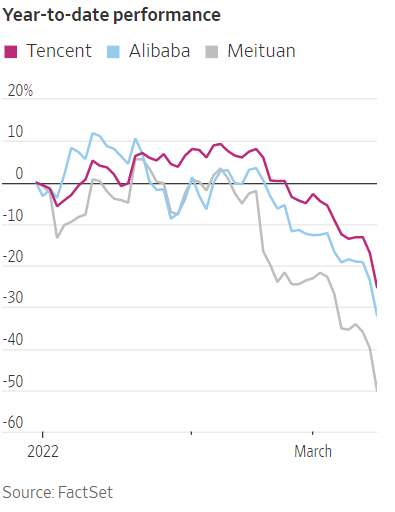

Shares of Tencent, which had been down 6.8% on Monday before the Journal’s story, extended their losses to nearly 10% and closed at their lowest level in nearly two years, according to FactSet. A broader selloff in Chinese stocks drove the Hang Seng Index down 5% Monday.”Tencent, a social media and videogame behemoth, has so far been largely unscathed by Beijing’s sweeping crackdown on big internet platforms that began in late 2020. Chinese authorities have given heavy fines to e-commerce heavyweight Alibaba Group Holding Ltd. and food-delivery giant Meituan for anticompetitive business practices, launched cybersecurity probes into ride-hailing leader Didi Global Inc. and its peers, and forced a business overhaul at financial-technology giant Ant Group Co., whose Alipay network competes with WeChat Pay.

Last year, a Tencent subsidiary, Tencent Music Entertainment Group, was stripped of its exclusive rights to some music labels. Tencent also failed to engineer a merger between two videogame streaming platforms that both count it as a shareholder. Still, Tencent as a group and WeChat, its crown jewel, have avoided substantial reprimands and penalties from Chinese authorities.

The impending fine for Tencent comes as Chinese fintech platforms are bracing for a fundamental change in the government’s approach to curbing money laundering activities. Last June, the government published a draft amendment to its anti-money-laundering law that sought to broaden and deepen the scope of its regulations. The PBOC also said last year that nonbank payment companies have obligations to detect and prevent money laundering, just like banks and other financial institutions.

The amendment also opens the door to much higher penalties on companies, which could be fined for every violation count—meaning fines could add up to large sums—and gives more PBOC branches power and discretion to levy fines in their jurisdictions. That raises the stakes for mobile-payment platforms like WeChat Pay and its archrival Alipay, because of the massive volume of financial transactions that they facilitate.

The PBOC, in its most recent annual anti-money-laundering report, said it imposed fines totaling 526 million yuan, or $83 million, on 537 institutions in 2020. Common money laundering offenses involved activities such as gambling, smuggling and drug dealing, the report said.

Tenpay Payment Technology Co., the licensed entity that runs WeChat Pay, was previously hit with small fines that typically were less than 10 million yuan. The new fines are likely to be far higher, because China is seeking to bring its anti-money-laundering enforcement up to international standards, some of the people familiar with the matter said.

WeChat, a do-everything app, boasts 1.26 billion monthly active users, the majority of them in China. Its embedded payment function is used by many individuals to pay for purchases online and in stores, as well as for peer-to-peer money transfers. Tens of millions of merchants in China accept payments made via WeChat Pay.

In the second half of last year, the PBOC’s various branches across China conducted comprehensive inspections at WeChat Pay, the people familiar with the matter said. Those inspections—which look for compliance lapses—are performed on all licensed financial institutions and are typically carried out once every three years, some of the people said.

Ant’s Alipay is due to be inspected this year, some of the people said. It would be the first time the company’s operations are scrutinized in this manner since the cancellation of Ant’s initial public offering in November 2020. Alipay has been preparing for the examination and has conducted simulated inspections, people familiar with the matter said.

Both Ant and Tencent are required to set up financial holding companies—overseen by the PBOC—that encompass all of their licensed financial operations. Ant has been working with regulators to turn itself into a financial-holding company, which will include all its payment, banking, insurance, credit-scoring, fund management and other licensed activities. The road map for Tencent, however, is more nuanced and complex.

WeChat Pay and other financial services have long been integral to the WeChat app, which has myriad other functions such as messaging, gaming and shopping. It remains to be seen if WeChat Pay will be separated from the broader ecosystem to be housed in Tencent’s financial-holding company.

Tencent President Martin Lau said in an earnings call last year that setting up the financial holding company would “involve organizational change, but it doesn’t really impact the businesses,” he said. The Wall Street Journal

You must be logged in to post a comment Login