Antenna

The changing face of the broadcast equipment industry

The continuous evolution of broadcast technology has resulted in a considerable increase in the capacity of the transmitted bandwidth and has enabled many more services, better picture quality, and improved coverage across the world.

With the rapid audience shift from television to digital, staying relevant in broadcast media is challenging but necessary for long-term viability. Broadcast television is not dead–but is evolving rapidly, and there is a need to transform to avoid becoming irrelevant. Transforming means shifting from serving a TV audience to serving audiences, no matter where they are–essentially, going from being a TV broadcaster to an overall broadcaster.

The demand for better-quality video and audio from consumers has resulted in products and technology being upgraded at a rapid pace in recent decades. With content being produced in UHD and 4K, transmission in the same format for improved quality of viewing has led to IP live-production technology. This is particularly significant for live production, where a premium is placed on flexible and efficient system control.

Broadcasters are adapting to the changes in trends to be able to stay relevant. They are focusing on identifying the key changes and emerging trends in broadcasting, which is helping the broadcasters in the industry for determining how to adjust media strategies, what tactics will lead to success, and how to better prepare for the future.

The broadcast equipment market

The global broadcasting equipment market has been growing at a moderate rate over the last 5 years on account of escalating eminence of broadcast automation and increasing number of digital channels. The market is estimated at USD 29.273 billion in 2019.

The global broadcast equipment market has been primarily influenced by the major shift of consumers to smartphones and other portable devices. Growing adoption of IoT has also boosted the adoption of smart connected devices that use ultra-high-definition (USD) screen. An increasing number of viewers are using their smartphones and connected devices to watch live broadcasts of sports or concert events. This is resulting in a positive impact.

The advancement in technology has further encouraged broadcasters to provide UHD output to its upgraded users, thereby fueling market growth. Increase in the number of digital channels, and growing adoption of advanced broadcasting equipment like video recorders and broadcasting cameras with up to 8K video quality in sports coverage and about 4K in news coverage, is providing impetus. High investment in digital platforms and hardware solutions across different countries has also propelled the market.

The sports genre has been the biggest draw for TV viewers across the globe, finding ways to deliver the video content at scale, and a rapidly increasing number of devices and formats present multiple challenges for broadcasters, service providers, content owners, and rights holders. Rental sports broadcast equipment market has been another major revenue generator for the broadcast equipment market. The increasing number of international sports tournaments across the globe has been a game changer for the rental market of the broadcast equipment. Moreover, increasing need for the preciseness in the decision review system is another factor that is propelling the need for the inclusion of hi-tech cameras in majority of the sports.

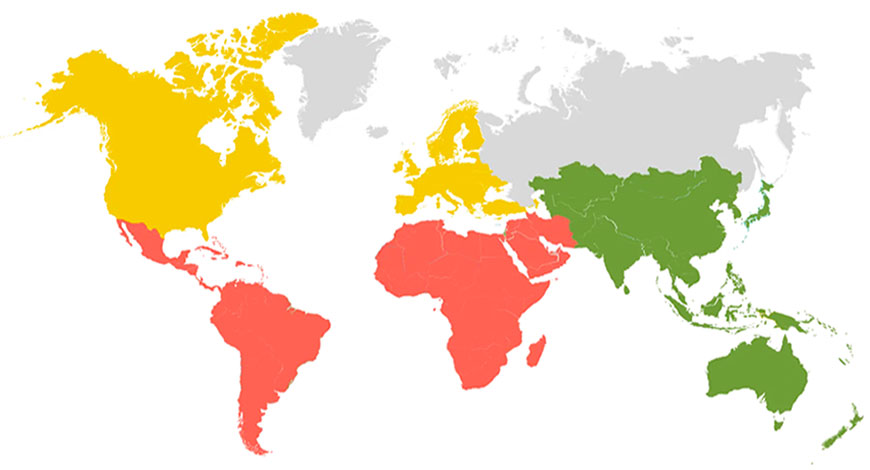

The North American broadcasting equipment market is estimated to hold a significant share and is increasing at a notable pace. The Asia-Pacific region is expected to grow at a significant CAGR on the back of increasing investments by market players to boost the adoption and upscale the development of enhanced equipment.

The equipment market is highly competitive, consisting of the presence of many small and large players operating in domestic as well as in the international market. The market appears to be moderately concentrated, with major players adopting strategies as product innovation, strategic partnerships, and mergers and acquisitions primarily to broaden their product portfolio and expand their geographic reach in order to achieve competitive advantage in the market. Major players operating in the broadcast and digital media sectors are increasingly innovating new technologies and generating new content to increase their revenue in their online platforms that offer hours of media-related content like music and films.

Some of the leading players include Grass Valley, Ericsson, Cisco, Evertz Microsystems, Harmonic, EVS Broadcast, Sencore Clyde Broadcast (SA), AvL Technologies, Acorde Technologies, Global Invacom Ltd., and ETL Systems Ltd.

The COVID-19 outbreak is having a critical impact on the broadcaster’s revenues as firms across the globe have been reluctant to spend on ads. The brands are to use their limited cash reserves, especially when in an economy shutdown, demand is surppressed.

The IP revolution

The broadcasters seeking to offer live news, sports, and other live content, which makes the scope of live programming is at the peak. As live programming supports broadcasters in contrast to the intrusion of OTT services, the demand for live IP is soaring. Continuous investment in R&D for the development of future technologies, like a new production system, is anticipated to provide ample growth opportunities to the players operating in the live IP broadcasting equipment market.

For nearly 80 years, the broadcast industry relied on expensive, inflexible infrastructure comprised of bulky and disparate hardware systems and long-term vendor agreements that were ripe to be disrupted. But now, an industry that was slow to change has awoken to the possibilities of a more flexible, dynamic future and today the adoption of IP for live and live linear video delivery is increasing across the media industry. It is one of the most rapid and significant industry transformations in history and IP is a huge enabler of this movement.

The media industry is migrating quickly to hybrid IP networks to transport broadcast-quality live and live linear video through and across its workflows. IP networks can be the internet, fiber, cellular (4G, 5G), or IP over satellite, and with the right video platform it can consist of combinations of hybrid networks with bonded or sequential hitless networks for 99.99 percent-plus reliability.

There are a number of factors driving this change, including the rise of consumer cord-cutting affecting how and where content is consumed; a rapid move to cloud virtualization for more cost-effective, flexible broadcast infrastructures; mega-merger integration of companies in the media space; relentless pressure to cut costs; and the impending localization of 5G and its impact on how much C-Band will be available for broadcast and the interference factor.

Make no mistake, views are changing on how broadly to use IP networks as the backbone of media workflows, especially the open internet. Yet despite the prevalence of this IP-adoption trend, there remain some industry hold outs who still need to be persuaded that IP networks can be as, or even more, reliable than satellite and fiber when architected correctly.

Satellite market undergoes radical transformation

Growing population base shifting from cable TV to satellite TV is a key driver of the global broadcasting equipment market. Satellite TVs provide better, customizable plans, and enhanced picture quality, which a cable TV cannot provide due to the constraints in the coaxial cable it is sent over. The satellite TV segment captured the largest share of 43.22 percent based on revenue in 2019 on the back of a growing trend amongst users toward subscription for bundled packages that offer both pay-TV and OTT services.

The provision to offer UHD picture quality with relative ease as compared to other transmission systems continues to provide high adoption rates. Additionally, the provision to set up and run satellite transmission in diverse locations to witness broadcast of live events like sporting events and live news, is contributing to market growth.

Satellite TV providers like DISH and DIRECTV are taking initiatives and making investments in order to provide up to 4K quality, and increase the number of their subscribers. These factors are increasing the demand for better and technologically advanced broadcasting equipment, thus positively impacting the overall market growth.

A factor not helping the conventional satellite-based TV market is the downward pressure on pricing. This is good for the consumer and business end-user but not so appealing to the infrastructure owners. Satellite operators are discovering that their well-established businesses are now being commoditized. The only premium for transponder rentals, for example, is the fact that millions of dishes are pointed toward a particular satellite. Moving them to another operator’s orbital location would be massively expensive.

Nevertheless, the satellite market will experience a radical transformation in the quantity, value, and mass of the satellites to be built and launched with a four-fold increase in the number of satellites at a yearly average of 990 satellites to be launched, compared to a yearly average of 230 satellites in the previous decade. This market value will reach USD 292 billion over the next decade. This reflects a 28-percent increase over the previous decade, which totaled USD 228 billion in revenues.

The global fixed satellite services market size reached USD 20.9 billion in 2019. These services use ground equipment at predetermined locations to receive and transmit signals. The stations use very-small-aperture-terminal (VSAT) technology for providing high-speed communication, and are used for various services, including TV signals for broadcasting. Fixed satellite service (FSS) has a low power output and comprises large dish-style antennas for improved reception. These services provide high-speed internet services and offer reliable and affordable connectivity to meet the requirements of the users, especially while traveling. These advantages associated with FSS are increasingly replacing direct broadcasting satellites (DBS) across the globe.

The global space ground station equipment market is projected to grow at a significant CAGR of 4.32 percent and 3.81 percent, in terms of value and volume, respectively, by 2024. By value, the market is anticipated to reach USD 119.78 billion by 2024. Countries like the US, the UK, and China are the most prominent ones in the space ground station equipment market. The Asia-Pacific is anticipated to grow at the highest rate due to an increasing requirement of satellite-connecting infrastructure to attain sustainability. With the huge growth in small satellites, there has been an emergence of new companies that are increasingly investing in the development of ground station network for small satellites.

Space ground station is equipped with a number of equipment, broadly classified into consumer and network segment.

Consumer is the dominant segment in the market and includes dish antenna, satellite radios, and mobile satellite terminals, among others. Space ground station equipment serve base for satellite communication services like fixed and mobile satellite services. Fixed satellite service is the dominant segment in the market due to high penetration of dish TVs, globally.

Video storage

Video-processing solutions offer end-to-end video solutions like IP conversion, streaming, video storage, and an analytical approach for better video output. Increasing technological advancements have transformed the broadcasting industry as content providers, and TV broadcasters are effectively using internet accessibility and the cross-device compatibility video functionality that helps them to grow subscriber base.

Advances in broadband services have increased access to data for real-time video broadcasting, which provides better video quality to viewers. Increased spending on digital advertising is also expected to create profitable opportunities for content providers and network operators in the global market for video processing solutions.

The market will be driven by growing customer demand for high-quality video. Improved infrastructure to deliver high-quality video, increasing need for multi-device compatible video, increased spending on digital video advertising, and increased internet accessibility in developing countries. However, the complexity of video processing can be a limiting factor that can have a negative effect on the market growth.

Data sustainability will trend in 2020. The tidal wave of data is growing with each click. Over the next decade, companies will be tasked with finding an environment-friendly way to store and transport it. Several organizations are looking to go green by cooling their video servers with fresh-air-based systems and even leveraging the heat emitted from server facilities as a source of renewable energy.

Transmitters

The number of coronavirus cases is increasing rapidly, which has not only taken a number of lives but has also affected the global economic structure. The COVID-19 pandemic has affected all parts of the world. The virus has changed all the market conditions and is hampering the growth of various sectors of the global FM broadcast transmitters market.

Manufacturers are facing continued downward pressure on demand, production, and revenues as the COVID-19 pandemic strengthens. They are preparing for major global supply chain disruptions. And, some of the key players are mainly focusing on R&D to provide innovative products to clients.

Radio. The FM broadcast radio transmitter market has been garnering remarkable momentum in the recent years. The steadily escalating demand due to improving purchasing power is projected to bode well for the market. The industry is relatively concentrated; manufacturers are mostly in the US and Europe. The worldwide market for radio transmitters is expected to reach USD 720 million by 2024.

TV. Television is undergoing a huge transformation with the rise of the internet and digital technologies. The global TV transmitters market is expected to reach USD 680 million by the end of 2024. The changing consumer demographics in developing countries and the rising trend for online TV are propelling the growth of the market.

Geographically, Europe accounts for the largest share in TV transmitters market. The Asia-Pacific region is also growing at a good pace due to the increasing disposable income in countries like India and China. However, the bandwidth issues associated with TV transmitters and the range of the transmitters are expected to curtail the growth of the market. On the other hand, the broadcasters require transmission systems that operate more efficiently in order to address the increasing demand for lower operating costs and an eco-friendlier method.

Successful transitions from moving analog to digital transmission, and the installation of mobile TV and other multimedia networks, may further need scores of transmitters in significantly varying sizes and power levels, thereby challenging the support logistics and expanding the costs of installation and maintenance of the transmitters.

Currently, there are mainly three types of TV transmitters–low-power, medium-power, and high-power TV transmitters.

OTA. The global over-the-air (OTA) transmission platform market size is expected to reach USD 124.3 million by 2025, rising at a market growth of 4.5 percent CAGR. The worldwide demand for OTA transmission platforms is growing among broadcasters and display devices manufacturers, as various manufacturers of television and streaming devices have launched ATSC 3.0-capable televisions on the OTA transmission platform market. The growing need for better channel visibility and operational flexibility is expected to drive the market for the OTA transmission platform in the coming years.

The OTA transmission platform is helping broadcasters to send 4K video over wireless transmission platforms along with improved quality of picture. In the OTA application would be incorporated the higher audio quality called 3D multichannel sound, which helps broadcasters provide high-quality audio to consumers. The hybrid combination of OTA and OTT combination is expected to generate opportunities for the OTA transmission platform market because it enables the users to access content from any platform.

Growing R&D expenditure in the broadcasting industry and growing on-demand content adoption are expected to drive the market. Rising IT investments in the broadcasting industry are expected to provide growth opportunities for the vendors worldwide, particularly in North America.

The key factor driving market growth is the increased demand for better image quality and wireless transmission platforms. The extensive need for improved channel presentation and quality of operations is also expected to fuel the market growth. The shortage of sufficient OTA infrastructure, however, is projected to hinder market growth. Increasing R&D spending and IT investment in the broadcasting sector is also expected to provide the industry with significant growth opportunities in the coming years.

Switchers market expands steadily

The global broadcast switchers market will reach USD 2.3 billion by 2027, growing at a CAGR of 4.7 percent. The HD segment is projected to grow at a 4.9 percent CAGR to reach USD 1.9 billion. After an early analysis of the business implications of the pandemic and its induced economic crisis, growth in the SD segment is readjusted to a revised 4.3-percent CAGR. This segment currently accounts for a 11.4-percent share of the global broadcast switchers market.

The US market is estimated at USD 483.6 million in the year 2020. The country currently accounts for a 29.47-percent share in the global market. China is forecast to reach an estimated market size of USD 402.4 million in 2027, trailing a CAGR of 4.5 percent through 2027. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 4.4 percent and 4 percent, respectively. Within Europe, Germany is forecast to grow at approximately 4.5 percent CAGR while rest of European market will reach USD 402.4 million.

In the global 4K segment, USA, Canada, Japan, China, and Europe will drive the 3.4-percent CAGR. These regional markets accounting for a combined market size of USD 99.1 million in 2020, will reach a projected size of USD 125.3 million by the end of 2027. China will remain among the fastest growing in this cluster of regional markets. Led by countries, such as Australia, India, and South Korea, the market in Asia-Pacific is forecast to reach USD 253.5 million by 2027.

Countries around the world are progressively shifting from analog to digital broadcasting, and particularly in developed countries, this transition has been rather significant. To achieve this transition, countries are investing in infrastructure, which has resulted in an increased demand for broadcast switchers, as such, positively contributing to the growth of the global broadcast switchers market.

Broadcasters are increasingly focusing on product innovation so as to replace conventional SDI-based environment with live production systems that offer system control with high efficiency. These efforts are helping to shape the further evolution of the broadcast switchers market.

Rapidly progressing technology that has paved the way for better audio and video quality has led to the ready availability of HD and 4K resolutions, on the back of viewers’ and producers’ requirements for the same. HD broadcast switchers that support HD video broadcasting, which is better than SD resolution, is expected to increase at a value CAGR of ~5 percent. However, growing faster is the 4K resolution broadcast switchers segment and is expected to double by the end of 2027. The rapid growth of 4K broadcast switchers that support 4K UHD can be attributed to the popularity of 4K technology.

North America, among the earliest adopters of new technology, including HD and 4K UHD, is expected to remain lucrative for players, as it will continue to hold its place at the top of the table, and reach ~415 thousand units by the end of 2027. The growth in the region is likely to be driven by the increased use of broadcast switchers in the non-broadcast segment in the foreseeable future.

However, increase in the adoption of these broadcast switchers in developed and developing countries in APAC has led to this region growing rapidly in the global broadcast switchers market. By revenue, APAC is anticipated to expand by a CAGR of 5.5 percent and hit the ~USD 550 million market by 2027.

The global broadcast switchers market is witnessing rise in the adoption of content delivery through multi-screens. This trend is expected to have a high impact on the global market, especially the markets in developed economies, wherein consumers are demanding simpler access to television content. This has transformed several broadcasters, who currently offer content through the cloud. Cloud-based delivery enables broadcasters to offer content via web video platforms, with access though IPTV, mobile applications, and other online portals.

For instance, the rise of streaming media service providers, such as Netflix, Apple TV, Amazon, Hulu, Boxee, and Roku is challenging the traditionally maintained supremacy of television as the key entertainment hub.

Moreover, subscription-based digital content providers and OTT service providers have also acted as a catalyst for the growth of audio/video data streaming. The need for less maintenance and technological upgrades for multi-screen content distribution have encouraged various production houses to switch to these new omni platforms.

Thus, the number of devices used to access digital content has greatly increased in recent years. This has expanded the array of platforms by which a user can access streamed audio and video content.

However, the impact of high cost is higher for small- and medium-scale companies operating in the TV broadcasting sector. Digital migration policies have put added pressure on consumers to buy a digital set-top-box and/or upgrade to digital TV sets. This is a major factor reducing digitization in sub-Saharan countries, and restraining the broadcast switchers market in developing economies.

The switchers market remains strong and broad; hence, there are still various models available for purchase, from IP to SDI and hardware to software. Although IP is gaining serious momentum in the industry, a lot of customers are still looking for solutions that are both SDI- and IP-friendly, signifying that there is no one-size-fits-all switcher.

There is a lot of interest from smaller productions, such as those run by houses of worship or corporate markets, so there is a need for broadcast-standard switchers at entry-level budgets that fit into smaller production environments. For the same reasons, there will also be more solutions that combine switching with other core production functionality.

Crunch time for codecs

Video encoders are the devices or circuits used for conversion of analog video signals into video stream by connecting them with analog video cameras. The signals are being carried by various IP networks like LAN, intranet, and internet. Some of the major video codecs are H.264, VP8, and RV40 with different compression standards. The global video encoders market is estimated to reach USD 2.69 billion by 2025, registering a CAGR of 5.8 percent by 2025.

The benefits associated with video codecs like stability, reliability, and accuracy are the prominent factors fueling the market demand. Growing demand for diagnostic information and measurement data is further fueling the market growth. Expanding the high-tech and media sector, coupled with the rising demand for UHD video content, is also projected to augment the market growth.

The rise in the adoption of cloud services has also fueled the growth of the market. As cloud provides a large amount of storage space for the data, it is convenient for users to store data on the cloud rather than on hard disks or any physical storage devices; this helps in reducing costs.

The growing popularity of high-efficiency video coding (HEVC) standard is also propelling the growth of the market across the globe. Moreover, the introduction of multi-channel video encoders has allowed the user to generate multiple different streams resulting in a reduction of hardware.

HEVC has been around since 2013, offering a lot of promise but resulting in very low acceptance until recently. HEVC can deliver up to 50 percent better data compression than AVC/H.264 at the same video quality or, alternatively, substantially improved video quality at the same bit rate. This ability opens the door for the delivery of 4K and HDR video over existing delivery networks to the growing universe of viewing platforms. While the required processing power of HEVC is about 10 percent greater than that of AVC, there is also a reduction in storage requirements–a fair tradeoff for many content creators and programmers.

In 2019 Global Media Formats Report by Encoding.com, 12 percent of all video produced in 2018 utilized HEVC. In 2017, the vast majority of HEVC usage was strictly for testing and development, but in 2018 and 2019 many more production workflows began employing the standard.

Some of this growth can be attributed to growing adoption of high-resolution formats, such as Dolby Vision and HDR+, both of which are compatible with HEVC.

Another factor is the ability to integrate HEVC within HLS streams, today’s de facto standard for adaptive bitrate streaming. HEVC’s time looks to have finally come. Producers are deploying HEVC to deliver upgraded formats to new devices, but not to harvest the bandwidth savings or reduce OpEx.

Entering the second half of 2020, there are a raft of developments, giving media streamers, device manufacturers, and chipset vendors a multitude of options to trade operational performance with price. Key developments include two new standards, MPEG-5 EVC and MPEG LCEVC. VVC, another MPEG standard, is also on course for standardization by the year-end.

Meanwhile, AV1, which is being promoted as an alternative to MPEG schemes, is having to battle a patent pool challenge for AV1 implementation–contrary to a key reason for setting AV1 up in the first place, which was to be royalty free.

Since the COVID-19 outbreak in December 2019, the disease has spread to almost 100 countries around the globe. The global impacts of the disease are already starting to be felt, and will significantly affect the video codecs market in 2020.

Way forward

After the COVID-19 pandemic upended thousands of businesses and market shares globally, the global broadcast equipment market 2020 is looking firm and streamlining with higher shares by the end of 2023. The global market for high-speed cameras might reposition and expand at a growth rate of ~6 percent during the same year frame, with the value of USD 6 million.

The primary drivers boosting the broadcast equipment market include a fast surge in demand for UHD content production. Its effective transmission and drastic inclination from hardware-oriented systems to software and open-architecture-based systems have influenced the product to be adopted at a higher rate. The rising demand for D2C (direct-to-consumer) offerings through OTT services and multi-channel networks in developed economies is expected to help boost the broadcast equipment market globally.

Investments in high-speed broadband infrastructure continue to surge globally, which propels the market more. However, as there extends to be a perpetual gap in the speed, but with efficient video compression technology, the lowest speeds are good enough for multi-screen video consumption.

Thus, on this parameter, the growth in digitization, rise in IT spending, and growing IT infrastructure and emerging economies form lucrative ways for various broadcast equipment vendors, especially for OTT services to invest hugely to gain profits. These factors are highly favoring the market, especially in the lockdown period led by the COVID-19 pandemic.

You must be logged in to post a comment Login