Cloud

The OTT TV Imbroglio

The M&E sector has a significant opportunity given India’s young demographics. With more than 800 television channels, and 100 million cable TV households, the Indian M&E sector has so far managed to buck the global trend and is growing at a healthy rate.

The sector is at a digital tipping point. The number of online video-viewing audience in India is estimated to be around 225 million in FY18 and is projected to reach 550 million by FY23, according to KPMG. But does this translate to lesser TV viewing? Will India go the US way in cord cutting?

The sector is at a digital tipping point. The number of online video-viewing audience in India is estimated to be around 225 million in FY18 and is projected to reach 550 million by FY23, according to KPMG. But does this translate to lesser TV viewing? Will India go the US way in cord cutting?

OTT is spurring additional consumption, unlocking new need spaces and not just substituting existing consumption. It will likely increase the per capita media consumption in India.

India will have more internet users than the entire population of Canada, France, Germany, Italy, Japan, United Kingdom, and USA put together by 2020, according to a BCG report. This would also mean rising consumption of videos via YouTube, Facebook, and Instagram that too could eat into the TV-viewing time.

A large number of people in the US consume video content directly on the internet through OTT platforms, such as Netflix and Amazon Prime, and have cut off their cable connections. For instance, Netflix’s subscriber base has reached 55 percent of all pay-TV home subscribers in the U.S. This has been driven by favorable price differential between the subscription fees of pay-TV and OTT services, aside from the availability of supporting network infrastructure and varied and rich content provided by OTT. In India too, Netflix seems to have already made a mark among the millennials. Youngsters do not want to negotiate for the remote anymore. Globally, Netflix is using its war chest of capital to buy, create, and license content at an unprecedented scale. It spent a mammoth USD 6 billion in 2017 and more than USD 8 billion on content last year. In India, too, it is expected to focus on building a library of content with mass and regional appeal. And once it has a bulk of regional content, Netflix will bring down subscription prices and cost for customers.

Leading Indian broadcasters, to shore up their clout, launched their own OTT businesses. Star India was among the first to make a bold investment in its OTT channel Hotstar, which set the ball rolling in the industry. Star India and Star US Holdings infused Rs 516 crore in August 2018, followed by another Rs 1066 crore in March 2019 into their wholly owned Nova Digital Media, which operates Hotstar. The company faces competition from Voot, Zee5, Arre, SonyLIV, ALT Balaji, EROS Now, and YouTube Originals, among others. Jio helped the cause, with its extremely competitive pricing on data. Today, Indian broadcasters have a fair play in India’s OTT space. India is perhaps the only country where broadcasters have organized their OTT business well.

According to Velocity MR, more than 70 percent of respondents claimed to watch Amazon Prime regularly at least once a week, followed by Netflix with 56 percent and Hotstar with 50 percent. Amazon Prime is lucrative to the price-sensitive Indian audience because it lets users become Amazon Prime members who get free, faster, and cheaper delivery of goods and also access to its video service. On the other hand, Netflix is banking on its original content, despite being priced a bit on the higher side.

Boston Consulting Group pegs the Indian OTT market at USD 5 billion by 2023. Overall, it is estimated that 16 percent of media consumption in India is already on digital media. The caveat is that key to realizing the USD 5 billion opportunity of the Indian OTT market hinges on overcoming the barriers to awareness of OTT apps and content offering.

Raj Nayak, ex COO, Viacom18 proclaims, “In OTT, the number of players will shrink by 2022 as there will be no more than 10 players left. That is when the real value will be unlocked whether it is subscription and advertising.”

Relative to developed countries, India is lagging. However, for the Indian youth, already 25 percent of media consumption is digital. This indicates that the growth in India is likely to catch up. The year 2017 saw the first burst of big money being deployed behind Indian content on OTT. The number of players in the Indian OTT market saw a 3.5-times jump in the last six years, growing from just 9 players in 2012 to 32 in 2018, says the BCG report.

While the incremental subscriber, the affluent customer, with a second TV connection, is likely to move to OTT platforms, urban India is distinct from rural India. As per the BCG report, over 40 percent of viewers prefer regional content.

However, we may not witness the same trend of cord cutting in India in the near term as in the US Cost is the main obstacle. Jehil Thakkar, partner, Deloitte India, asserts that television is, and will remain, the biggest medium for the foreseeable future in India. “For at least 10 years, TV and appointment viewing will continue in India. The reason is that TV is extremely affordable – you can get a basic cable for ₹120 a month or free-to-air channels via FreeDish for free,” says Thakkar. The numbers definitely reflect strong growth in the TV universe.

TV penetration is at 66 percent, which also means that 34 percent of households in India are yet to buy a TV set. On May 1, 2019, it was announced that 100 percent electrification had been achieved in 600,000 villages. If easy availability of data has contributed to the growth of the digital content business, new villages coming on the electricity map of India are contributing to the growth of the television market.

“Cable TV will continue to have more takers in India as the OTT platforms are relatively expensive. Television is one of the essential commodities in the country and consumption in India is actually 3 hours 44 minutes per household per day and when you go to South India, it increases to 4 hours-plus. With this kind of consumption, streaming could be expensive and cumbersome. Moreover, Netflix and Amazon do not offer the same content as most broadcasters,” says Karishma Bhalla, Partner and Director, Boston Consulting Group. The issue of censorship is also a consideration here.

A lot of traditional TV content is being watched on mobile screens while OTT content is being beamed regularly to TV screens at home. “We can no longer differentiate between broadcasters and OTT on the basis of content,” says Tarun Katial, CEO, ZEE5. Events like IPL 2018 aggregated audiences on OTT as well as TV. There is no such thing as TV content and digital content. If the popular Netflix series Sacred Games plays on Colors Infinity, it becomes TV content. Looking at the debate as linear versus non-linear can perhaps bring a distinction in content.

The future of cable may be no TV at all

There is a narrative in US media circles that Netflix, Amazon, and other technology companies are killing cable companies. Cord cutting is accelerating! No one watches cable TV anymore! The quieter truth is that many cable companies – maybe even most – do not really care.

Pay-TV aggregation is a worse business than high-speed broadband distribution, and it has been this way for years. Here is how the pay-TV business works: Traditional distributors such as Comcast, which owns CNBC parent company NBCUniversal; Charter; Altice; and Cox, the largest US cable TV distributor pay a per-subscriber rate for the right to broadcast a channel. Little-watched networks do not cost much – say, 5 cents per month per subscriber. The popular broadcast networks and cable stations, such as ESPN and Fox News, cost more.

The owners of these channels also own other channels, which they bundle in with their popular networks, leading to bloated cable TV packages and increasing prices. After the pay-TV operators add up all of the networks in the bundle, they tack on a little more and sell it to consumers. After years of programming rate increases, the cost of the bundle has become so high that pay-TV packages are low-margin or sometimes even negative-margin offerings. The business is even worse for new digital-video providers, which are starting from a base of zero and must keep prices low to attract new subscribers.

Cable companies stay in the TV business because they have millions of legacy customers who are willing to pay about USD 100 for their bundle, instead of the USD 40 per month YouTube charges. And if people threaten to cancel their TV packages, operators have cheaper packages they use as sweeteners for customers to pay up for high-speed broadband.

But now, this traditional coupling of TV and internet may be losing its efficacy. Pay-TV distributors see the writing on the wall. It is not just that digital video providers are offering competitive bundles. It is that nearly every large media company has a direct-to-consumer streaming service that if aggregated replaces the need for large bundles of channels. This is part of why AT&T, which already owns a giant pay-TV provider in DirecTV, is retooling WarnerMedia, leading to the departure this week of long-time Warner executives Richard Plepler and David Levy.

Maybe it won’t be Netflix, Amazon, or any outside force that kills cable TV. Maybe it will be the cable companies themselves!

IPTV drives Asia’s pay-TV growth

IPTV drives Asia’s pay-TV growth

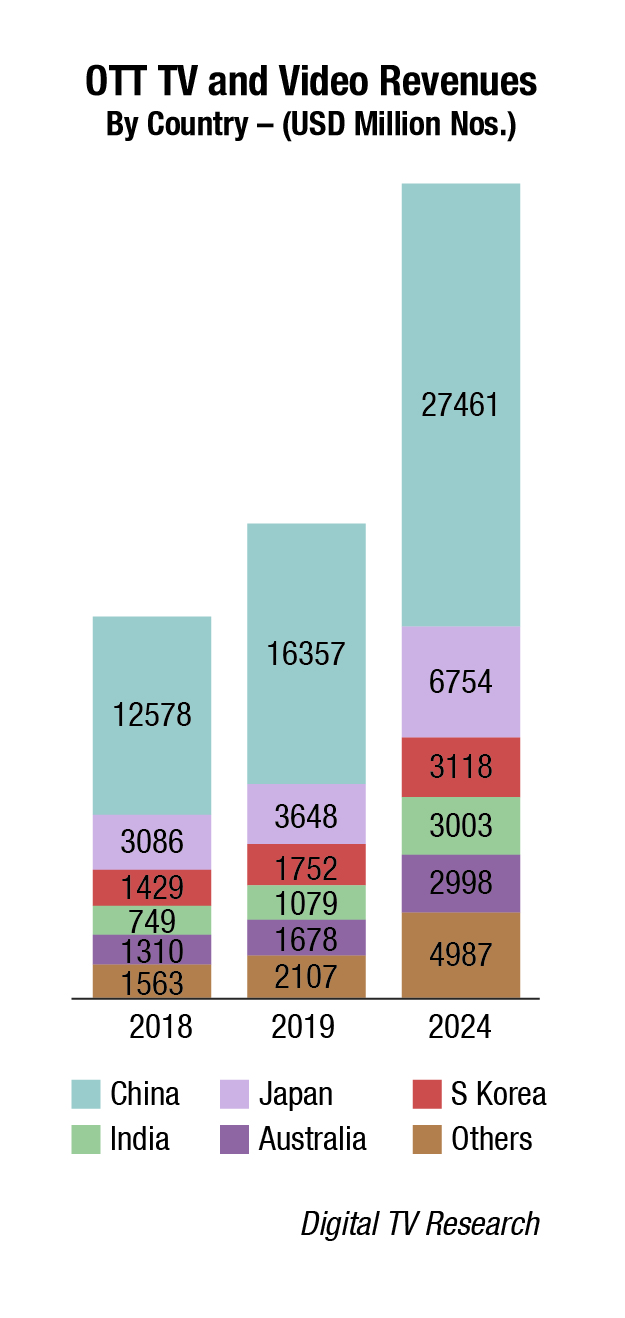

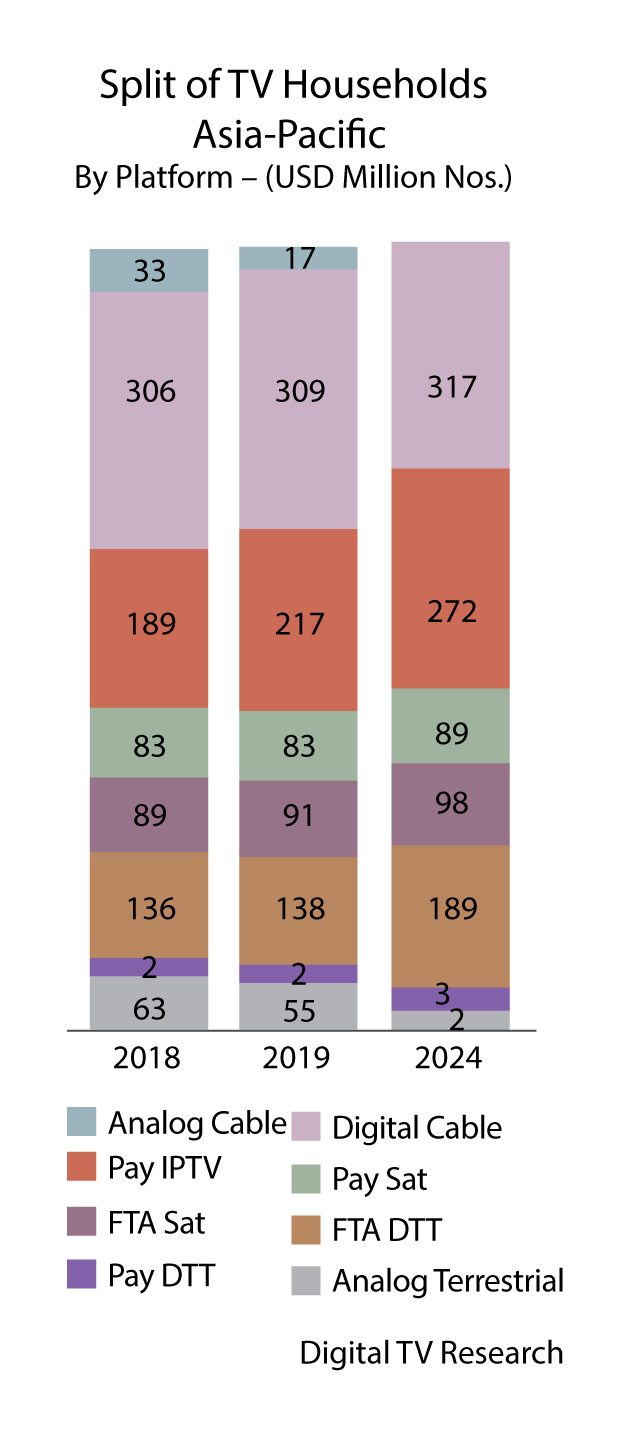

The Asia-Pacific pay-TV sector is vibrant, with both subscribers (up by 68 million) and revenues (up by USD 2.35 billion) forecast to rise over the next five years.

“IPTV is the biggest pay-TV winner – adding 83 million subscribers between 2018 and 2024 to take its total to 272 million. Much of this growth will happen in China (up by 40 million) as cable subs convert to OTT or IPTV, and in India (up by 28 million),” says Simon Murray, principal analyst at Digital TV Research.

Reliance is poised to shake up India’s staid fixed-broadband sector with its Jio GigaFiber operation, as it has done in the mobile sector. Cable will suffer. Digital cable subscriptions will be flat overall. China will lose 25 million cable subs between 2018 and 2024, although India will add 13 million. Analog cable subscriptions will fall by 33 million.

You must be logged in to post a comment Login